As you approach retirement, one of the questions you may ask yourself is “At what age should I stop my term life insurance policy?” The answer is not a one-size-fits-all, as it depends on your individual circumstances and financial goals. In this comprehensive guide, we’ll explore the factors you should consider when determining the right time to let your term life insurance policy expire.

Understanding Term Life Insurance

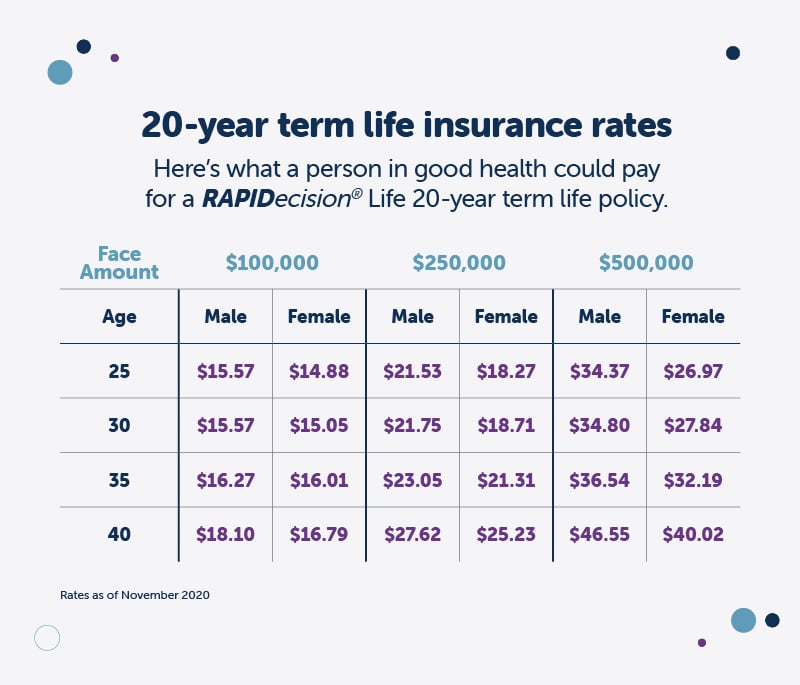

Term life insurance is a type of life insurance policy that provides coverage for a specific period, typically ranging from 10 to 30 years. It’s designed to provide financial protection for your loved ones in case of your untimely death during the term of the policy. Unlike whole life insurance, term life insurance does not accumulate cash value and is generally more affordable, making it a popular choice for many families.

Factors to Consider When Deciding to Stop Term Life Insurance

Determining the right age to stop your term life insurance policy involves evaluating your current financial situation, future goals, and the needs of your dependents. Here are some key factors to consider:

1. Retirement Status

One of the primary reasons for having life insurance is to provide financial security for your dependents in case of your untimely death. As you approach retirement age, your dependents may become financially independent, reducing the need for life insurance coverage. If you have retired and your children are self-sufficient, you may no longer require term life insurance.

2. Mortgage and Debt Obligations

If you have paid off your mortgage and other significant debts, the need for life insurance may diminish. Life insurance is often used to ensure that outstanding debts are covered in the event of the policyholder’s death, providing financial stability for their loved ones.

3. Income Replacement Needs

Term life insurance is frequently used to replace lost income for dependents in case of the policyholder’s death. If you no longer have dependents relying on your income or if you have accumulated sufficient retirement savings, the need for income replacement through life insurance may be reduced.

4. Estate Planning and Inheritance Considerations

While term life insurance is primarily designed to replace income and cover debts, some individuals may choose to keep their policies active to leave an inheritance for their beneficiaries. If leaving a financial legacy is important to you, maintaining your term life insurance policy may be a consideration.

5. Health and Life Expectancy

As you age, your health and life expectancy may change, which can impact the cost and availability of life insurance coverage. If you have a significant health condition or a shorter life expectancy, it may be more cost-effective to keep your existing term life insurance policy rather than attempting to acquire a new one at an advanced age.

6. Alternative Financial Arrangements

Before letting your term life insurance policy expire, consider alternative financial arrangements you may have in place. For example, if you have substantial savings, investments, or other assets that can provide financial security for your loved ones, the need for life insurance may be reduced.

When to Stop Term Life Insurance

Based on the factors mentioned above, here are some general guidelines for when you may consider stopping your term life insurance policy:

-

Age 60-70: If you have retired, your children are financially independent, and you have paid off your debts, this may be an appropriate time to let your term life insurance policy expire.

-

Age 70-75: If you have a comfortable retirement nest egg, no significant outstanding debts, and your primary goal is not to leave an inheritance, you may consider allowing your term life insurance policy to lapse.

-

Age 75 and beyond: If you have reached an advanced age and your primary concern is to leave an inheritance for your beneficiaries, you may want to maintain your term life insurance policy or explore alternative options, such as a whole life insurance policy or an annuity.

It’s important to note that these age ranges are general guidelines, and your specific situation may differ. It’s always advisable to consult with a financial advisor or an insurance professional to determine the most suitable course of action based on your unique circumstances.

Alternatives to Term Life Insurance

If you decide to let your term life insurance policy expire, there are alternative options to consider:

-

Whole Life Insurance: If leaving an inheritance is a priority, you may explore the option of converting your term life insurance policy to a whole life insurance policy, which provides lifelong coverage and accumulates cash value.

-

Final Expense Insurance: Also known as burial insurance, this type of policy is designed to cover end-of-life expenses, such as funeral costs and outstanding medical bills.

-

Annuities: Annuities can provide a stream of income during retirement, which can help replace the financial protection offered by life insurance.

-

Investment Accounts: Building a diversified investment portfolio, such as a retirement account or a taxable brokerage account, can serve as a source of funds for your loved ones after your passing.

The Bottom Line

Deciding when to stop your term life insurance policy is a personal decision that should be based on your individual circumstances, financial goals, and the needs of your dependents. By carefully evaluating factors such as retirement status, debt obligations, income replacement needs, estate planning considerations, health, and alternative financial arrangements, you can make an informed decision about the appropriate age to let your term life insurance policy expire.

Remember, it’s always advisable to consult with a qualified financial advisor or insurance professional to ensure that you are making the best decision for your specific situation. They can provide valuable guidance and help you explore alternative options that align with your long-term financial goals and legacy planning.

When Should You Cancel Your Term Life Insurance?

FAQ

When should I stop term life insurance?

How long should you have term life insurance?

Is there a cut off age for term life insurance?

What happens at age 80 with term life insurance?