Paying bills can be a tedious task. Thankfully, Bank of America offers a convenient bill pay service that allows customers to easily manage and pay bills online or via mobile app. But for first-time users, navigating bill pay can be confusing. Here, we’ll walk through the most frequently asked questions to help demystify Bank of America’s bill pay.

How Do I Enroll in Bill Pay?

Enrolling in bill pay is simple for existing Bank of America online banking customers. Just log into your account and click on the “Bill Pay” tab. You’ll be prompted to accept the bill pay terms and conditions. Once you agree you can start adding payees immediately.

If you don’t currently use Bank of America’s online banking, you’ll first need to enroll and accept the online banking terms. Then follow the same steps above to activate bill pay.

What Types of Accounts Can I Use for Bill Pay?

You can pay bills from any Bank of America checking, savings, SafeBalance Banking, or Home Equity Line of Credit account. You can also use accounts from other financial institutions, but you’ll need to provide the routing and account numbers.

What Bills Can I Pay Through Bill Pay?

You can use Bank of America’s bill pay service to pay almost any company or person. Common bills include utilities, cable/internet, insurance, medical bills, rent, mortgage, credit cards, loans, gym memberships, newspaper subscriptions, and more The only bill you can’t pay directly through bill pay is your Bank of America credit card bill

How Do I Add Payees?

Adding a payee is easy. When you enroll in bill pay, you’ll be prompted to add payees. You’ll need the billing name, address, account number, and payment amount/due date from the bill. Bank of America has a database of popular payees that makes it easy to autofill information.

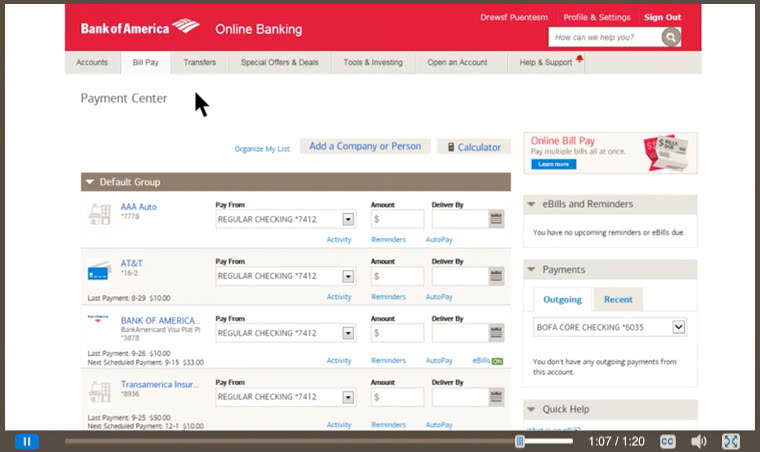

You can add, edit, and delete payees at any time under the “Payment Center” section of bill pay.

How Long Does an Online Payment Take to Reach the Payee?

Bank of America recommends scheduling bill payments at least 5 business days before the due date. This ensures adequate time for the payee to receive and process the payment. If you need to pay a bill the same day, you’ll want to use a different payment method like your bank’s online transfer service.

When Will the Payment Amount Deduct from My Account?

Funds for electronic bill payments are debited on the day the payment is scheduled. If paying a bill that requires a mailed check, the amount will deduct when the recipient deposits the check

For automatic scheduled payments, amounts debit on the scheduled date unless it falls on a non-business day. In that case, the payment processes the business day prior.

Are There Any Fees to Use Bill Pay?

Nope! Bank of America provides bill pay at no extra cost to customers. It’s a free value-added service.

How Do eBills Work?

eBills are electronic versions of paper bills delivered directly to your Bank of America bill pay account. When you enroll in eBills for a payee, you’ll receive an email notification each time a new eBill arrives. You can view, manage, and pay all eBills from the bill pay portal.

What Payment Options Do I Have for eBills?

eBills offer flexibility to pay how and when you want, including:

- Pay full or minimum amount due

- Schedule one-time future payments

- Set up recurring auto-pay based on eBill date/amount

- Pay manually each month

You control the payment settings for each eBill payee. And you can change them anytime.

Can I Cancel eBills?

Yes, cancelling eBills for any payee is easy. Just log into your Bank of America online account and go to the Bill Pay tab. Select the payee, click “Edit eBill options” and select “Cancel eBill.” eBills stop immediately.

How Long are eBill Statements Available Online?

Bank of America provides 24 months of eBill statement history through online banking and mobile app. You can access current and past eBill statements anytime.

What Happens If I Don’t Recognize a Charge on My Credit Card Bill?

Sometimes merchants bill under different business names or from states other than where you made the purchase. If you still don’t recognize the charge after reviewing past statements, contact the merchant directly for clarification.

How Do I Stop Paper Credit Card Statements?

You can opt out of mailed paper statements by enrolling in eBills through Bank of America’s online banking or mobile app. Under account settings, select “Statements & Documents,” then click “Paperless Settings” to turn off paper statements.

Going paperless also helps the environment!

Can I Use Bill Pay to Make Credit Card Payments?

Bill pay can’t directly pay Bank of America credit card bills. But you can easily make one-time or recurring payments through online/mobile banking. Transfer funds from your Bank of America checking or savings account to the credit card.

How Do I Set Up Automatic Credit Card Payments?

First, enroll in eBills for your credit card through online banking or mobile app. Then, access your eBills account, choose “Set up AutoPay”, select payment account, amount and delivery date, and save. Automatic payments will start next billing cycle.

What If I’m Having Trouble Making Credit Card Payments?

Contact Bank of America immediately if you’re struggling to make credit card payments. They have specialists who can help assess your situation and identify solutions, like repayment plans, balance consolidation, credit counseling, hardship programs, and more. Don’t wait – call as soon as an issue arises.

Bank of America offers a full-service bill pay platform that takes the hassle out of bill management. Their online banking and mobile app make it easy to enroll, add payees, view bills, schedule one-time/recurring payments, and resolve issues. Follow this bill pay FAQ guide to master the basics and simplify your financial life.

Get the mobile banking app

Before you leave our site, we want you to know your app store has its own privacy practices and level of security which may be different from ours, so please review their polices.

We sent an email with the download link to

We sent a text message with the download link to

Using Bill Pay is easy

Set up one-time or recurring payments with Bill Pay. You can even pay other financial institutions using your Bank of America accounts. Once youâre enrolled in Online Banking, you can pay bills using the Mobile Banking app.

Bank of America -How to Set Up Online Bill Pay

How do I use bank of America’s Online bill pay?

First-time Bill Pay users will need to enroll in Online Banking and accept Bank of America’s Online Banking terms and conditions. Once you have enrolled, log in to Online Banking and select the Bill Pay tab (you will also be asked to accept the terms and conditions associated with using Bank of America’s online Bill Pay).

Can I pay my bank of America credit card bill by phone?

Yes, you can pay your Bank of America credit card bill by phone. To make your Bank of America credit card payment over the phone, call (800) 236-6497 and follow the instructions from the automated menu, then enter your payment information. The process should only take a few minutes. Call Bank of America at (800) 236-6497.

How do I pay my bank of America credit card?

Submit your payment. It’s worth noting that you can also make your Bank of America credit card payment on your phone by using the Bank of America mobile app. In addition, you can pay online, by mail, or in person at a branch. Paying online will generally be the fastest method.

How do I use bank of America mobile banking?

Enter your U.S. mobile number, and we’ll text you a link to download the Bank of America® Mobile Banking app so you can get started. Payments made through Bill Pay with your Bank of America Advantage SafeBalance Banking® account will be withdrawn from your account before delivery to the payee.