Paying bills is a necessary but often tedious task for any business. However, with QuickBooks Online Bill Pay, you can automate and streamline bill payments right within your QuickBooks Online account In this comprehensive guide, we’ll explore how QuickBooks Online Bill Pay works and all the ways it can save you time while giving you greater control and visibility into your accounts payable

Overview of QuickBooks Online Bill Pay

QuickBooks Online Bill Pay is an add-on service that allows you to pay bills directly from within your QuickBooks Online account. With Bill Pay, you can:

- Schedule one-time or recurring payments to vendors

- Pay bills by check or ACH transfer

- Manage when and how bills get paid

- View payment history and generate reports

- Avoid late fees by scheduling payments in advance

- Streamline approval workflows

Bill Pay integrates directly with your QuickBooks chart of accounts, vendors, and bills. As soon as you schedule a payment, QuickBooks records the transaction for you. There’s no need for duplicate data entry or exporting bills to an outside system.

Bill Pay also includes useful features like the ability to schedule partial payments or pay multiple bills in one click And with the Payable Network, Bill Pay can automatically retrieve your vendors’ payment details so you don’t have to enter them manually.

Benefits of Using QuickBooks Online Bill Pay

Here are some of the biggest benefits of using QuickBooks Online Bill Pay

Streamlined Workflows

With Bill Pay, you don’t have to juggle between different systems or tabs to pay your bills. The entire process – from entering bills to scheduling payments – happens right within your QuickBooks account. This saves you time and eliminates opportunities for errors.

Increased Visibility

Since Bill Pay is directly integrated with QuickBooks Online, you have complete visibility into upcoming payments, payment history, and accounts payable aging. Running AP reports is easy when all your data is in one place.

Better Cash Flow Management

Bill Pay gives you control over when bills get paid. Schedule payments in advance and QuickBooks will automatically withdraw the funds on the date you specify. This makes it easy to align payments with cash inflows and avoid late fees.

Reduced Data Entry

QuickBooks automatically imports vendor bill details when you sync with Bill Pay. And when paying bills, QuickBooks maps payment info to the right accounts so you don’t have to enter anything manually.

Improved Vendor Relationships

Get notifications when bills are received and view payment confirmations when bills are paid. This level of communication improves vendor relationships and ensures on-time payments.

How QuickBooks Online Bill Pay Works

Here is an overview of how QuickBooks Online Bill Pay works:

-

Connect your bank accounts – When signing up for Bill Pay, connect the bank accounts you want to use to fund payments. Bill Pay uses Plaid to securely connect your accounts.

-

Import bills – When you receive a bill from a vendor, you can easily import it into QuickBooks Online as a bill. Bill details like amount due and payment dates get populated automatically.

-

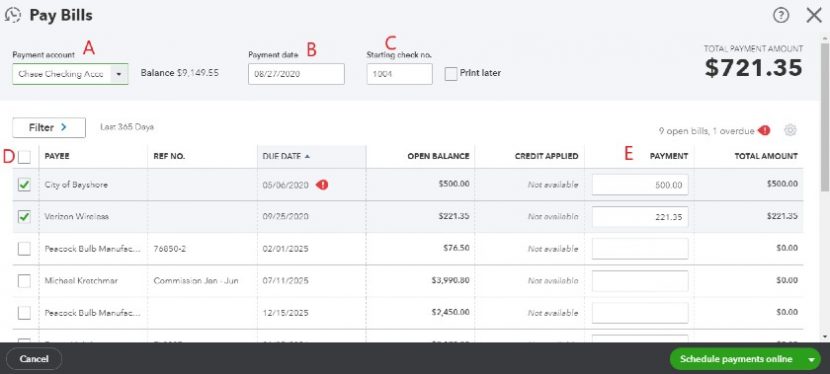

Schedule payments – Within QuickBooks, you can schedule one-time or recurring payments on any bill with just a couple clicks. Select the amount to pay, date to withdraw funds, and payment method.

-

Review payment details – Before payments are finalized, you have a chance to review all the payment info and confirm it’s accurate.

-

Funds withdrawn – On the date you select, Bill Pay will automatically withdraw funds from your connected bank account and process the payment.

-

Confirmation & recording – You and the vendor will receive confirmation emails when the payment is made. QuickBooks will also automatically record the bill payment transaction.

It’s that easy! Bill Pay handles all the payment logistics while QuickBooks maintains your books and provides visibility into payables.

Bill Pay Pricing and Plans

QuickBooks Online Bill Pay is available as an add-on to all QuickBooks Online plans. There are three pricing tiers:

- Basic – $0/month, includes 5 free ACH payments per month

- Premium – $15/month, includes 40 free ACH payments per month

- Elite – $90/month, unlimited ACH payments

The Basic plan is a great option if you only have a handful of bills to pay each month. Premium offers more flexibility for businesses with higher payment volume. And Elite is designed for companies that process very high payment volumes each month.

If you need to pay bills by check, there is a $1.50 per check transaction fee. You can also enable faster next-day ACH payments for an additional $10 per payment.

One of the best things about Bill Pay pricing is that there are no extra user fees. All employees on your QuickBooks Online plan can access and use Bill Pay at no additional cost.

Key Features of QuickBooks Online Bill Pay

QuickBooks Online Bill Pay comes packed with features that make managing payables a breeze. Here are some of the key capabilities:

-

Schedule recurring payments – Set up recurring payments for expenses like rent, subscriptions, or loan payments that repeat regularly. QuickBooks will automatically withdraw funds on the scheduled date each period.

-

Partial & bulk payments – Easily pay a portion of a bill instead of the full amount. Or select and pay multiple bills in just a couple clicks.

-

Payment reminders – Get email alerts when bills are due or payments fail to remind you to take action.

-

Vendor management – Store vendor details like payment methods, 1099 status, and contact info to streamline payments.

-

Payment approval – Set up advanced workflows requiring supervisor approval before payments get scheduled.

-

Reporting – Generate reports on cash flow, payables aging, vendor payments, and more with a few clicks.

-

International payments – Only U.S. payments are supported currently, but international payments are on the roadmap.

-

Mobile access – Manage bills and payments on-the-go with the QuickBooks mobile app.

These features provide end-to-end accounts payable automationcapabilities not typically found in a small business accounting solution.

Getting Set Up with QuickBooks Bill Pay

Ready to get started enjoying the benefits of QuickBooks Online Bill Pay? Here is a quick 4-step guide to get you up and running:

-

Sign up – If you don’t already have QuickBooks Online, sign up for a plan and add Bill Pay during initial setup. Current users can enable Bill Pay in the payments section.

-

Connect accounts – Use Plaid to securely connect the bank accounts you want to use to fund payments.

-

Sync vendor info – QuickBooks will automatically sync vendors from your Payables Network so payment info stays up-to-date.

-

Schedule payments – Start scheduling one-time or recurring payments to vendors directly within QuickBooks Online.

And that’s it! Bill Pay will handle collecting funds and processing payments. As you schedule payments, your QuickBooks chart of accounts and reporting will automatically stay up-to-date.

Paying Bills Without Bill Pay

While Bill Pay automates the bill payment process, you can still manage payables manually within QuickBooks Online without Bill Pay.

Here’s how bill payment works without Bill Pay:

- Enter bills into QuickBooks Online as usual

- Export a list of bills from QuickBooks and load into your bank’s online bill pay portal

- Log into your bank and manually schedule bill payments

- Record the bill payments in QuickBooks after they are withdrawn from your bank

As you can see, this process involves a lot of manual work, duplication of data between systems, and opportunities for error. QuickBooks Bill Pay eliminates those hassles by allowing you to manage the full payment workflow within QuickBooks Online.

Is QuickBooks Bill Pay Right for Your Business?

QuickBooks Bill Pay is a great choice if:

- You use QuickBooks Online as your accounting system

- You want to streamline accounts payable workflows

- Your business issues a high volume of bill payments each month

- You want better visibility and control over cash flow

Businesses that are still managing bills and payments manually can benefit tremendously from the automation and integration Bill Pay provides.

However, if your business has complex AP needs or specialized processes, a standalone accounts payable solution may be a better fit. QuickBooks Bill Pay is designed for basic bill management and payment capabilities, not advanced or robust AP automation.

For most small businesses, QuickBooks Bill Pay hits the sweet spot between convenience, simplicity, and value. But assess your specific needs before deciding if it’s right for your company.

QuickBooks Bill Pay Frequently Asked Questions

Here are answers to some of the most common questions about QuickBooks Bill Pay:

How is Bill Pay different than online bill pay through my bank?

Bank bill pay is disconnected from your books. With QuickBooks Bill Pay, payments are automatically recorded in your accounting system.

Can I pay international vendors?

Not currently, but Intuit is planning to add support for international payments in the future.

**How do I add bill

How vendors are notified when you schedule a bill payment

We email your vendor twice.

First email will notify the vendor that you scheduled a bill payment to be sent to them.

Second email will notify the vendor that the payment is on its way and when to expect the bill payment.

We dont notify your vendors in case of payment cancellations or failures. Make sure to reach out to them directly if there are any issues with your scheduled bill payment.

How to cancel your Bill Pay subscription

- Sign in to your QuickBooks Online company file.

- Go to Settings

and select Account and settings.

and select Account and settings. - Select Billing & subscription.

- Find QuickBooks Bill Pay and select Unsubscribe.