As you navigate the world of Medicare, the question of financial privacy often arises. Can Medicare access your bank account? The answer is not a simple yes or no but rather a nuanced exploration of the program’s eligibility requirements and verification processes. In this comprehensive guide, we’ll shed light on when and how Medicare may need to access your financial records, ensuring you’re well-informed and prepared.

Understanding Medicare’s Financial Assistance Programs

Medicare provides various financial assistance programs to help beneficiaries with limited resources cover their healthcare costs. These programs include:

- Qualified Medicare Beneficiary (QMB) Program: Assists with Medicare Part A and Part B premiums, deductibles, coinsurance, and copayments.

- Specified Low-Income Medicare Beneficiary (SLMB) Program: Covers Medicare Part B premiums.

- Qualified Individual (QI) Program: Helps pay Medicare Part B premiums.

- Extra Help: Provides assistance with prescription drug costs under Medicare Part D.

To determine eligibility for these programs, Medicare considers both your income and asset levels, including the balances in your bank accounts.

When Does Medicare Check Bank Accounts?

Medicare primarily checks bank accounts when you apply for financial assistance programs that have asset limits. The eligibility criteria for these programs vary by state, but generally, the following scenarios may trigger a review of your bank accounts:

-

Initial Application: When you first apply for a needs-based Medicare assistance program, you will be required to provide information about your income, assets, and bank account details.

-

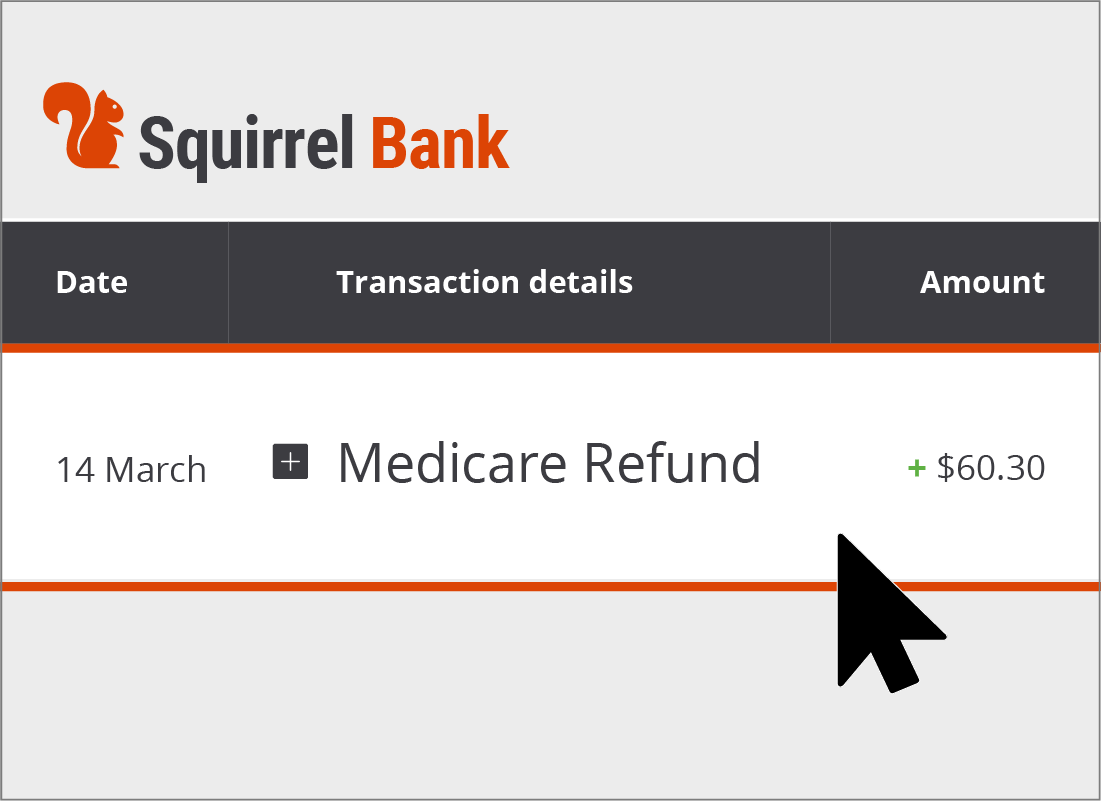

Periodic Verification: Even after you’ve been approved for a program, Medicare may periodically reverify your eligibility by requesting updated financial information, including bank statements.

-

Reported Changes: If you report any significant changes in your financial situation, such as receiving an inheritance or selling valuable assets, Medicare may request additional documentation to ensure you still qualify for the assistance program.

It’s important to note that not all states have asset limits for their Medicare Savings Programs. In states like Alabama, Arizona, Connecticut, Delaware, Mississippi, New York, Oregon, Vermont, and the District of Columbia, bank account information may not be required for these specific programs.

How Does Medicare Verify Bank Account Information?

Medicare employs various methods to verify the information you provide about your bank accounts and other assets. These include:

- Electronic Asset Verification Systems (AVS): Most states have implemented electronic systems that allow them to query financial institutions directly for information on your accounts.

- Third-Party Vendors: Medicare may contract with third-party vendors that have access to financial data and can provide asset verification services.

- Document Requests: In some cases, Medicare may request official bank statements or other financial documents from you to verify the information you provided.

It’s crucial to understand that providing inaccurate or incomplete information about your bank accounts and assets could result in penalties, delays in coverage, or disqualification from assistance programs.

Tips for a Smooth Application Process

To ensure a smooth application process and avoid any potential issues, consider the following tips:

- Be Transparent: Disclose all relevant financial information, including bank accounts, investment accounts, and other assets, to the best of your knowledge.

- Gather Documentation: Have your bank statements, investment account statements, and other financial records readily available in case they are requested.

- Stay Up-to-Date: Promptly report any changes in your financial situation to Medicare, as this could impact your eligibility for assistance programs.

- Seek Guidance: If you’re unsure about the eligibility requirements or the verification process, don’t hesitate to seek guidance from Medicare representatives or local assistance programs.

By being proactive and transparent about your financial information, you can help ensure a smooth application process and avoid any unnecessary delays or complications.

Remember, Medicare’s financial assistance programs are designed to help those with limited resources access affordable healthcare. By providing accurate information about your bank accounts and assets, you can ensure that these programs serve their intended purpose and provide the support you need.

How Much Money Can a Medicaid Recipient Have in the Bank? | Attorney Answers Question

FAQ

Does Medicare look at your bank accounts?

How much money can you have in your bank account on Medicare?

Can the government access your bank account without your permission?

Can Medi-Cal see your bank account?