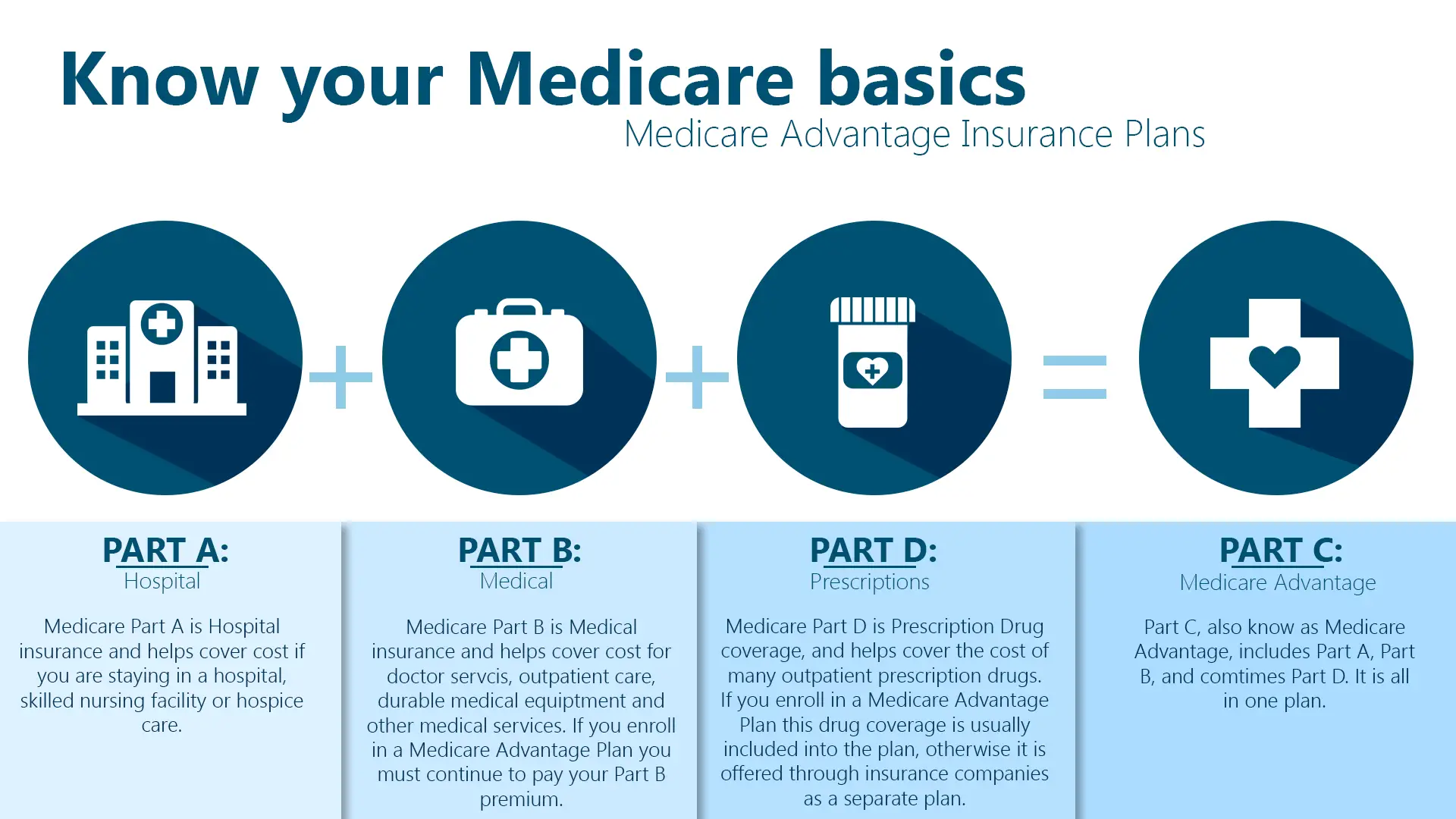

Medicare Advantage Plans, also known as Part C, offer a comprehensive package of benefits that provide coverage for a wide range of healthcare services. These plans are designed to be an alternative to Original Medicare (Parts A and B), bundling together hospital insurance, medical insurance, and often prescription drug coverage (Part D). However, it’s essential to understand that even with the extensive benefits offered by Medicare Advantage Plans, there are certain services and items that are not covered. In this article, we’ll explore what Medicare Advantage Plans typically don’t cover, helping you make informed decisions about your healthcare coverage.

Key Services Not Covered by Medicare Advantage Plans

While Medicare Advantage Plans cover all medically necessary services that Original Medicare covers, there are a few exceptions. Here are some of the key services and items that are typically not covered:

1. Clinical Trials

Clinical trials, also known as clinical research studies, are not covered by Medicare Advantage Plans. These trials are designed to test new treatments, interventions, or devices to evaluate their effectiveness and safety. If you’re in a Medicare Advantage Plan and participate in a clinical trial, Original Medicare will help cover some costs associated with the trial, such as routine costs for items and services you would typically receive if you were not part of the trial.

2. Hospice Care

Medicare Advantage Plans do not cover hospice care, which is a program of palliative care for individuals with a terminal illness and a life expectancy of six months or less. If you’re enrolled in a Medicare Advantage Plan and choose to receive hospice care, you will revert to Original Medicare for the services related to your terminal illness and hospice care. Original Medicare will cover the hospice services, while your Medicare Advantage Plan will continue to cover any healthcare services unrelated to your terminal illness.

3. Long-term Care (Custodial Care)

Long-term care, also known as custodial care, refers to non-medical care for individuals who require assistance with activities of daily living, such as bathing, dressing, and eating. Medicare Advantage Plans do not cover long-term care services provided in nursing homes, assisted living facilities, or at home. This type of care is typically covered by other insurance policies or paid for out-of-pocket.

4. Routine Dental Care

While some Medicare Advantage Plans may offer additional benefits like routine dental care, such as cleanings, fillings, and dentures, Original Medicare and most Medicare Advantage Plans do not cover routine dental services. If you require dental care, you may need to purchase a separate dental insurance plan or pay out-of-pocket for these services.

5. Routine Vision Care

Similar to dental care, routine vision care, such as eye exams for prescription glasses or contact lenses, is not covered by Original Medicare or most Medicare Advantage Plans. However, some Medicare Advantage Plans may offer additional vision benefits, including routine eye exams, glasses, or contact lenses. It’s important to review your plan’s benefits to understand what vision services are covered.

6. Cosmetic Surgery

Medicare Advantage Plans do not cover cosmetic surgery or procedures that are not medically necessary. This includes procedures such as facelifts, liposuction, and other procedures intended solely for improving appearance.

While these are some of the most common services and items not covered by Medicare Advantage Plans, it’s essential to review your specific plan’s coverage details carefully. Some Medicare Advantage Plans may offer additional benefits beyond what Original Medicare covers, such as fitness programs, over-the-counter medications, or transportation services.

It’s crucial to understand the limitations of your Medicare Advantage Plan to avoid unexpected out-of-pocket costs and ensure you have appropriate supplemental coverage or resources to cover any services not included in your plan.

If you’re unsure whether a particular service or item is covered, don’t hesitate to contact your Medicare Advantage Plan provider or consult with a healthcare professional. By being informed and proactive, you can make the most of your Medicare Advantage Plan and ensure you receive the healthcare coverage you need.

5 Things Medicare Doesn’t Cover (and how to get them covered)

FAQ

What does Medicare Advantage not cover?

What is the big difference between Medicare and Medicare Advantage?