Are you considering enrolling in a Medicare Supplement Insurance (Medigap) plan but worried about being denied coverage due to pre-existing conditions? It’s a common concern, but understanding the rules and regulations surrounding Medigap plans and pre-existing conditions can help alleviate your fears. In this article, we’ll dive deep into the topic and provide you with all the information you need to make an informed decision.

What are Pre-Existing Conditions?

Before we delve into the specifics of Medigap plans and pre-existing conditions, let’s define what a pre-existing condition is. A pre-existing condition is a health condition or illness that you were diagnosed with or received treatment for before your new health coverage begins.

Medigap Open Enrollment Period: Your Best Chance

One of the most critical periods for enrolling in a Medigap plan is during your Medigap Open Enrollment Period. This six-month window starts on the first day of the month in which you turn 65 and are enrolled in Medicare Part B. During this time, you have the following advantages:

- You can enroll in any Medigap policy sold in your state without being denied coverage due to pre-existing health problems.

- Insurance companies cannot use medical underwriting to decide whether to accept your application.

- You can avoid or shorten waiting periods for pre-existing conditions if you have creditable coverage from a previous health plan.

The Medigap Open Enrollment Period is a one-time opportunity, and it does not repeat every year like the Medicare Open Enrollment Period. Enrolling during this period ensures that you have the best chance of obtaining a Medigap policy without any restrictions or penalties related to pre-existing conditions.

Guaranteed Issue Rights

Even if you miss your Medigap Open Enrollment Period, there are certain situations called “guaranteed issue rights” or “Medigap protections” where an insurance company cannot deny you a Medigap policy due to pre-existing conditions. These situations include:

- You have lost your employer or group health plan coverage.

- You have terminated your Medicare Advantage plan or Medicare SELECT plan.

- Your Medigap plan’s insurer went bankrupt or misled you.

Under these circumstances, you have a guaranteed issue right to enroll in a Medigap plan without facing any pre-existing condition exclusions or waiting periods.

Pre-Existing Condition Waiting Periods

If you enroll in a Medigap plan outside of your Open Enrollment Period or without a guaranteed issue right, the insurance company may impose a pre-existing condition waiting period. This waiting period can last up to six months, during which the Medigap plan may not cover your pre-existing conditions.

However, there are ways to avoid or shorten this waiting period:

- If you had creditable coverage (such as an employer-sponsored health plan or a Medicare Advantage plan) before enrolling in your Medigap plan, the waiting period is reduced by the number of months you had creditable coverage. For example, if you had six months of creditable coverage, the pre-existing condition waiting period would be eliminated entirely.

- Some Medigap policies do not impose pre-existing condition waiting periods at all, regardless of when you enroll.

It’s important to note that if you had a break in coverage of more than 63 days, you cannot use your previous creditable coverage to reduce the pre-existing condition waiting period.

Comparing Medigap Policies

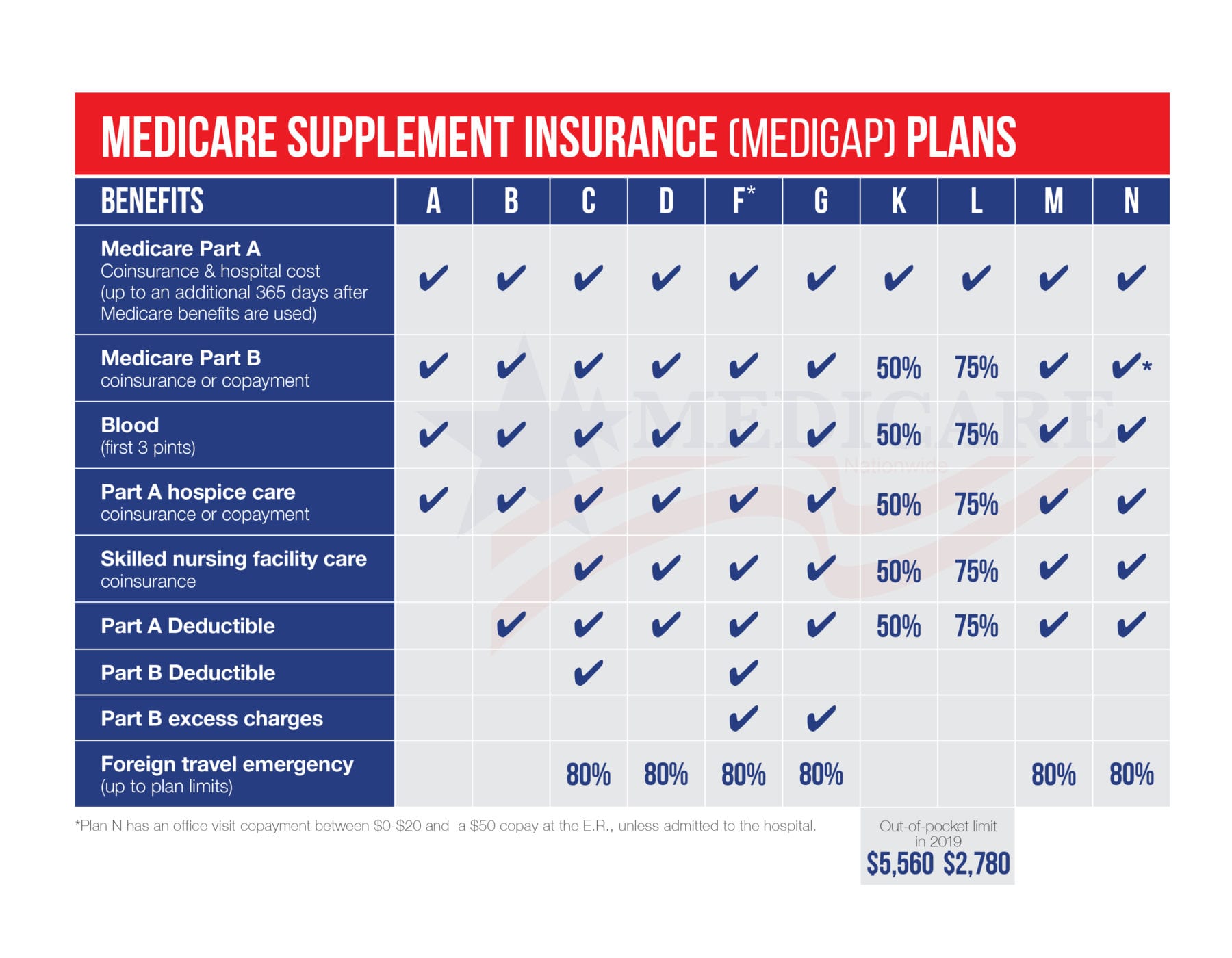

When shopping for a Medigap policy, it’s crucial to compare different plans and their pre-existing condition policies. Some plans may have more favorable terms than others, especially if you have known pre-existing conditions.

Here are a few tips to help you compare Medigap policies:

- Check if the plan imposes a pre-existing condition waiting period and how long it lasts.

- Determine if the plan allows you to use creditable coverage to reduce or eliminate the waiting period.

- Compare the premiums and out-of-pocket costs between plans with different pre-existing condition policies.

- Consider your current health status and the likelihood of needing coverage for pre-existing conditions in the near future.

By thoroughly evaluating your options, you can find a Medigap plan that best suits your needs and provides adequate coverage for any pre-existing conditions you may have.

Conclusion

While pre-existing conditions can be a concern when enrolling in a Medigap plan, the rules and regulations surrounding them are designed to protect you as a Medicare beneficiary. By taking advantage of your Medigap Open Enrollment Period or understanding your guaranteed issue rights, you can obtain coverage without facing discrimination or excessive waiting periods due to pre-existing conditions.

Remember, it’s essential to carefully compare Medigap policies and their pre-existing condition policies to find the best fit for your specific circumstances. With the right plan and timing, you can ensure that your pre-existing conditions are covered and that you have the comprehensive coverage you need for your healthcare needs.

Medicare Supplement Health Questions – Can Medigap Companies Deny Your Pre-existing Conditions?

FAQ

How long can an insurer exclude coverage for a pre-existing condition on a Medicare Supplement?

Can I be denied health insurance because of a pre-existing condition?

Can Unitedhealthcare deny coverage for preexisting conditions?

Can you be denied a Medicare Supplement plan?