As you age, maintaining good oral health becomes increasingly important. Dental implants are a popular and effective solution for replacing missing teeth, but the costs can be prohibitive, especially for seniors on a fixed income. If you’re a Medicare beneficiary wondering if dental implants are covered, this comprehensive guide will provide you with the answers you need.

What are Dental Implants?

Dental implants are artificial tooth roots made of titanium or other biocompatible materials. They are surgically inserted into the jawbone to serve as a sturdy foundation for replacement teeth, known as crowns. Unlike dentures or bridges, dental implants are designed to be a permanent solution for missing teeth, providing a natural look and feel while restoring your ability to chew and speak comfortably.

Does Original Medicare Cover Dental Implants?

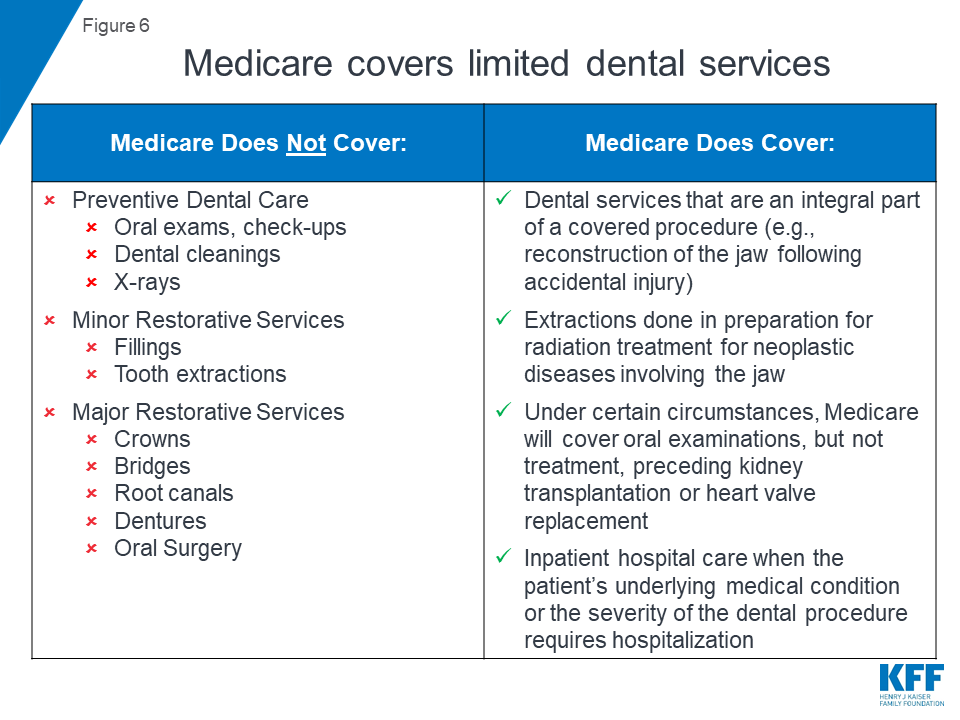

Unfortunately, Original Medicare (Parts A and B) does not cover the cost of dental implants or routine dental care, such as cleanings, fillings, or extractions. However, there are a few exceptions where Medicare may provide coverage for dental services:

- If dental treatment is required as part of a covered medical procedure, such as jaw reconstruction after an accidental injury or preparing for radiation treatment for certain cancers, Medicare may cover those dental services.

- If you require an oral examination or dental treatment before undergoing a qualifying medical procedure, such as a kidney transplant or heart valve replacement, Medicare may cover the cost of the dental work.

It’s important to note that these exceptions are limited, and coverage for dental implants specifically is not included under Original Medicare.

Alternative Options for Dental Implant Coverage

While Original Medicare may not cover dental implants, there are alternative options available to help with the costs:

-

Medicare Advantage Plans (Part C): Many Medicare Advantage plans, offered by private insurance companies, provide coverage for routine dental care and may offer benefits for dental implants. Coverage and out-of-pocket costs vary between plans, so be sure to review the details carefully before enrolling.

-

Stand-Alone Dental Insurance: You can purchase a separate dental insurance plan to supplement your Original Medicare coverage. Some plans may cover a portion of the costs associated with dental implants, although there may be limitations or waiting periods.

-

Medicaid: If you have limited income and resources, you may qualify for Medicaid. In some states, Medicaid covers certain dental services, including dental implants, for eligible beneficiaries.

-

Dental Savings Plans: These plans, offered by organizations like AARP or dental practices, provide discounted rates on dental services, including implants, from participating providers. While not traditional insurance, these plans can help make dental care more affordable.

Factors to Consider When Exploring Dental Implant Coverage

When evaluating your options for dental implant coverage, consider the following factors:

- Cost: Dental implants can be expensive, with a single implant costing anywhere from $3,000 to $6,000 or more, depending on your location and the complexity of the procedure.

- Copays and Deductibles: Even with insurance coverage, you may be responsible for copays, deductibles, and coinsurance, which can add up quickly.

- Network Restrictions: Some dental plans may have limited networks of participating providers, which could limit your choice of dentists or implant specialists.

- Annual Maximums: Many dental plans have annual maximums, limiting the amount the plan will pay towards your dental care in a given year.

- Waiting Periods: Some plans may have waiting periods before covering certain procedures, like dental implants, which could delay your treatment.

It’s essential to carefully review the details of any dental plan you’re considering to ensure it meets your needs and budget.

Taking the Next Step

If you’re a senior in need of dental implants, don’t let the cost deter you from seeking the treatment you need. Start by exploring your options through Medicare Advantage plans or stand-alone dental insurance policies. Consult with your dentist or implant specialist to understand the full scope of the procedure and associated costs.

Remember, maintaining good oral health is crucial for your overall well-being, and dental implants can be a valuable investment in your quality of life. With the right coverage and planning, you can make this important dental treatment more accessible and affordable.

Does Medicare Cover Dental Implants?

FAQ

Is it worth getting dental implants at 70 years old?

Are implants free with Medicare?

Are dental implants suitable for the elderly?

Does Medicare cover bone grafts for dental implants?