If you’re nearing age 65 or already enrolled in Medicare, you may be considering a Medicare Supplement Insurance plan, also known as Medigap. These plans are designed to cover some of the out-of-pocket costs that Original Medicare doesn’t pay for, such as deductibles, copayments, and coinsurance. However, many people wonder if they can be denied coverage for a Medigap plan due to pre-existing medical conditions or other factors.

The Medigap Open Enrollment Period: Your Best Chance

The most straightforward way to ensure you can’t be denied a Medigap plan is to enroll during your Medigap Open Enrollment Period. This is a six-month window that begins the month you turn 65 and enroll in Medicare Part B. During this time, insurance companies are required by federal law to sell you any Medigap plan they offer, regardless of your health status or pre-existing conditions.

Key points about the Medigap Open Enrollment Period:

- You can enroll in any Medigap plan available in your state without being denied or charged higher premiums due to health issues.

- Insurance companies cannot use medical underwriting to decide whether to accept your application.

- You can avoid or shorten waiting periods for pre-existing conditions if you have creditable coverage from another plan.

- This is a one-time enrollment period and does not repeat annually.

It’s crucial to take advantage of this window, as it offers the best opportunity to secure a Medigap plan without facing potential denial or higher costs.

Outside the Open Enrollment Period: Potential Challenges

If you miss your Medigap Open Enrollment Period, obtaining a Medigap plan can become more challenging. Insurance companies are generally allowed to deny you coverage or charge higher premiums based on your health status and medical history. Here’s what you can expect:

- You may have to pay more for a Medigap policy due to medical underwriting.

- Fewer policy options may be available to you, as insurance companies can choose which plans to offer.

- Insurance companies are allowed to deny you a policy if you don’t meet their medical underwriting requirements.

However, there are certain situations where you may still have guaranteed issue rights or Medigap protections, even outside the Open Enrollment Period. These are circumstances where insurance companies cannot deny you coverage or charge higher premiums due to pre-existing conditions.

Guaranteed Issue Rights and Medigap Protections

The U.S. government has established a series of guaranteed issue rights or Medigap protections that require insurance companies to sell you a Medigap plan, regardless of your health status. Some common scenarios where these protections apply include:

- Your Medicare Advantage plan is leaving Medicare, or you’re moving out of its service area.

- You have Original Medicare and an employer or union plan that pays after Medicare, and that plan is ending.

- You dropped a Medigap policy to join a Medicare Advantage plan, but you’ve been in the plan for less than a year and want to switch back.

- Your Medigap insurance company goes bankrupt, or your policy coverage ends through no fault of your own.

It’s essential to check with your State Insurance Department to understand if you qualify for any additional guaranteed issue rights under state laws.

Medicare Due to Disability or End-Stage Renal Disease (ESRD)

If you’re under 65 and have Medicare due to a disability or End-Stage Renal Disease (ESRD), you may face additional challenges in obtaining a Medigap plan. Federal law generally doesn’t require insurance companies to sell Medigap policies to individuals under 65.

However, some states have laws that mandate insurance companies to offer Medigap plans to those under 65 with certain qualifying conditions. It’s crucial to check with your State Insurance Department to understand your rights and options.

State-Specific Coverage Rules

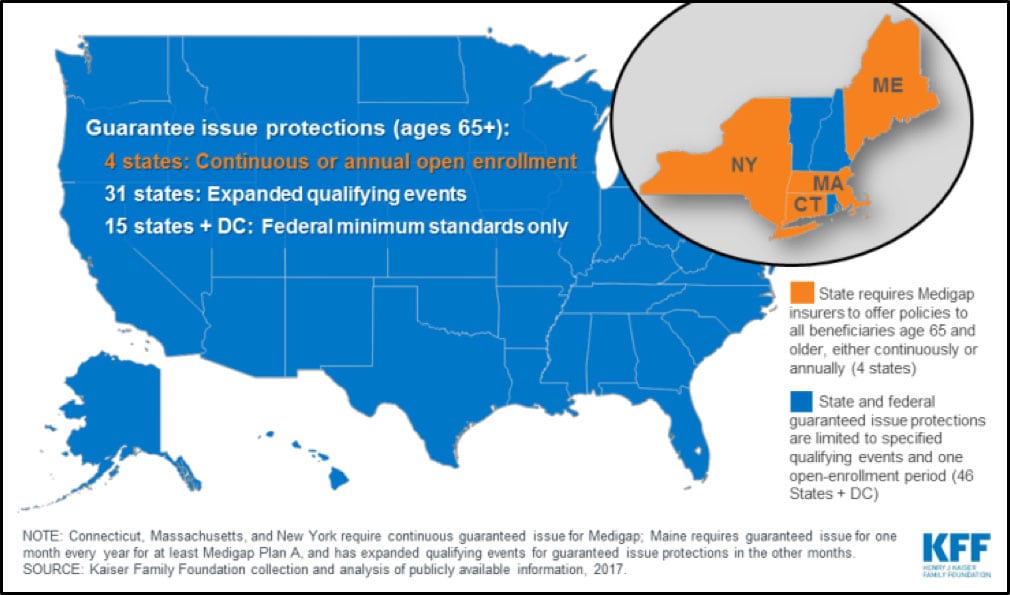

As of 2018, insurers in Connecticut, Maine, and New York are required by state law to sell Medicare Supplement Insurance to all state residents ages 65 or older, regardless of pre-existing conditions. This coverage is available either for the entire year or during a specific enrollment period.

If you live in one of these states and are nearing or over the age of 65, consult with an insurance agent to determine when you are eligible to buy a Medigap plan without the risk of denial due to health issues.

The Bottom Line

Obtaining a Medigap plan can be a straightforward process if you enroll during your Medigap Open Enrollment Period, as insurance companies cannot deny you coverage or charge higher premiums based on your health status. However, if you miss this window, securing a plan may become more challenging, and you may face denials or higher costs due to medical underwriting.

It’s essential to understand your rights, including guaranteed issue protections and state-specific laws, as these can provide opportunities to obtain a Medigap plan even if you have pre-existing conditions. Consulting with a licensed insurance agent or your State Insurance Department can help you navigate the process and make informed decisions about your Medicare Supplement Insurance coverage.

Can You be Denied Medicare Supplement?

FAQ

Can I be refused a Medigap plan?

What disqualifies you from Medigap?

Can Medicare supplements be denied?

Can Medigap deny coverage for preexisting conditions?