As you navigate the realm of Medicare, understanding the nuances between different plan options becomes crucial to ensure you make the best decision for your healthcare needs and budget. Among the various Medicare Supplement (Medigap) plans, Plans F and G stand out as popular choices, offering comprehensive coverage but with distinct differences. In this article, we’ll delve into the key distinctions between these two plans, empowering you to make an informed choice.

Understanding Medicare Supplement Plans

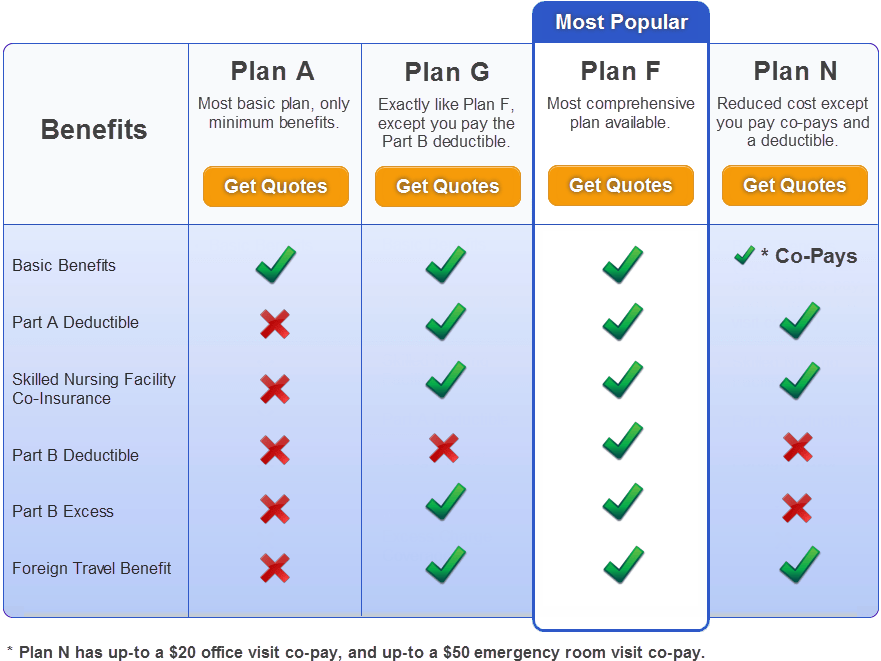

Medicare Supplement plans, also known as Medigap plans, are designed to fill the gaps in coverage left by Original Medicare (Parts A and B). These supplemental plans are offered by private insurance companies and help cover out-of-pocket costs, such as deductibles, copayments, and coinsurance, that would otherwise be your responsibility.

Plan F: The Comprehensive Coverage

Medicare Supplement Plan F is often referred to as the “Cadillac” of Medigap plans due to its extensive coverage. With Plan F, you generally have minimal or no out-of-pocket costs for Medicare-approved services, making it a popular choice for those seeking comprehensive protection.

Key features of Plan F:

- Covers the Medicare Part A deductible and coinsurance

- Covers the Medicare Part B deductible and coinsurance

- Covers the first three pints of blood each year

- Covers foreign travel emergency care (up to plan limits)

- Offers the highest level of coverage among all Medigap plans

However, it’s important to note that due to federal legislation, Plan F is no longer available for new Medicare beneficiaries who became eligible for Medicare on or after January 1, 2020.

Plan G: A Cost-Effective Alternative

Medicare Supplement Plan G has gained popularity as a cost-effective alternative to Plan F, particularly for those who became eligible for Medicare after 2020. While Plan G offers similar comprehensive coverage, there is one key difference: it does not cover the Medicare Part B deductible.

Key features of Plan G:

- Covers the Medicare Part A deductible and coinsurance

- Covers the Medicare Part B coinsurance (but not the deductible)

- Covers the first three pints of blood each year

- Covers foreign travel emergency care (up to plan limits)

- Generally has a lower monthly premium compared to Plan F

By not covering the Part B deductible, which is relatively low (currently $226 per year in 2023), Plan G can offer a more affordable option while still providing extensive coverage for most out-of-pocket expenses.

Choosing Between Plan F and Plan G

When deciding between Plan F and Plan G, it’s essential to consider your healthcare needs, budget, and potential out-of-pocket costs. Here are some factors to keep in mind:

-

Cost: Plan G typically has lower monthly premiums compared to Plan F, making it a more budget-friendly option. However, you’ll need to factor in the Part B deductible when calculating your potential out-of-pocket expenses with Plan G.

-

Coverage level: If you anticipate significant healthcare expenses or prefer the peace of mind of having virtually no out-of-pocket costs, Plan F may be the better choice. However, if you’re comfortable paying the Part B deductible and seeking a more affordable option, Plan G could be a suitable alternative.

-

Eligibility: If you became eligible for Medicare before January 1, 2020, you have the option to enroll in either Plan F or Plan G. However, if you became eligible on or after January 1, 2020, you can only enroll in Plan G (or other Medigap plans, excluding Plan F).

It’s also important to consider your overall health, anticipated healthcare needs, and potential for future medical expenses when evaluating the trade-off between premiums and out-of-pocket costs.

Making the Right Choice

Choosing the right Medicare Supplement plan is a personal decision that requires careful consideration of your individual circumstances. While Plan F offers the most comprehensive coverage, Plan G can be a cost-effective alternative for those willing to pay the Part B deductible.

To make an informed decision, it’s recommended to consult with a licensed insurance agent or a trusted healthcare professional who can guide you through the process and help you evaluate your options based on your specific needs and budget.

By understanding the key differences between Medicare Supplement Plans F and G, you can confidently navigate the Medicare landscape and select the plan that best aligns with your healthcare requirements and financial goals.

Plan G vs. Plan F Medicare Supplement -Which is the better choice?

FAQ

Is Medicare Plan F better than Plan G?

Why is Plan F being discontinued?

What plan G does not cover?

What are the disadvantages of Medicare Part G?