As you navigate the complexities of Medicare, one question that often arises is whether you can choose to decline or opt out of Medicare Part D, the prescription drug coverage component. While Medicare Part D is an optional benefit, the decision to decline it should be carefully considered, as it can have significant implications for your healthcare costs and coverage.

The Basics of Medicare Part D

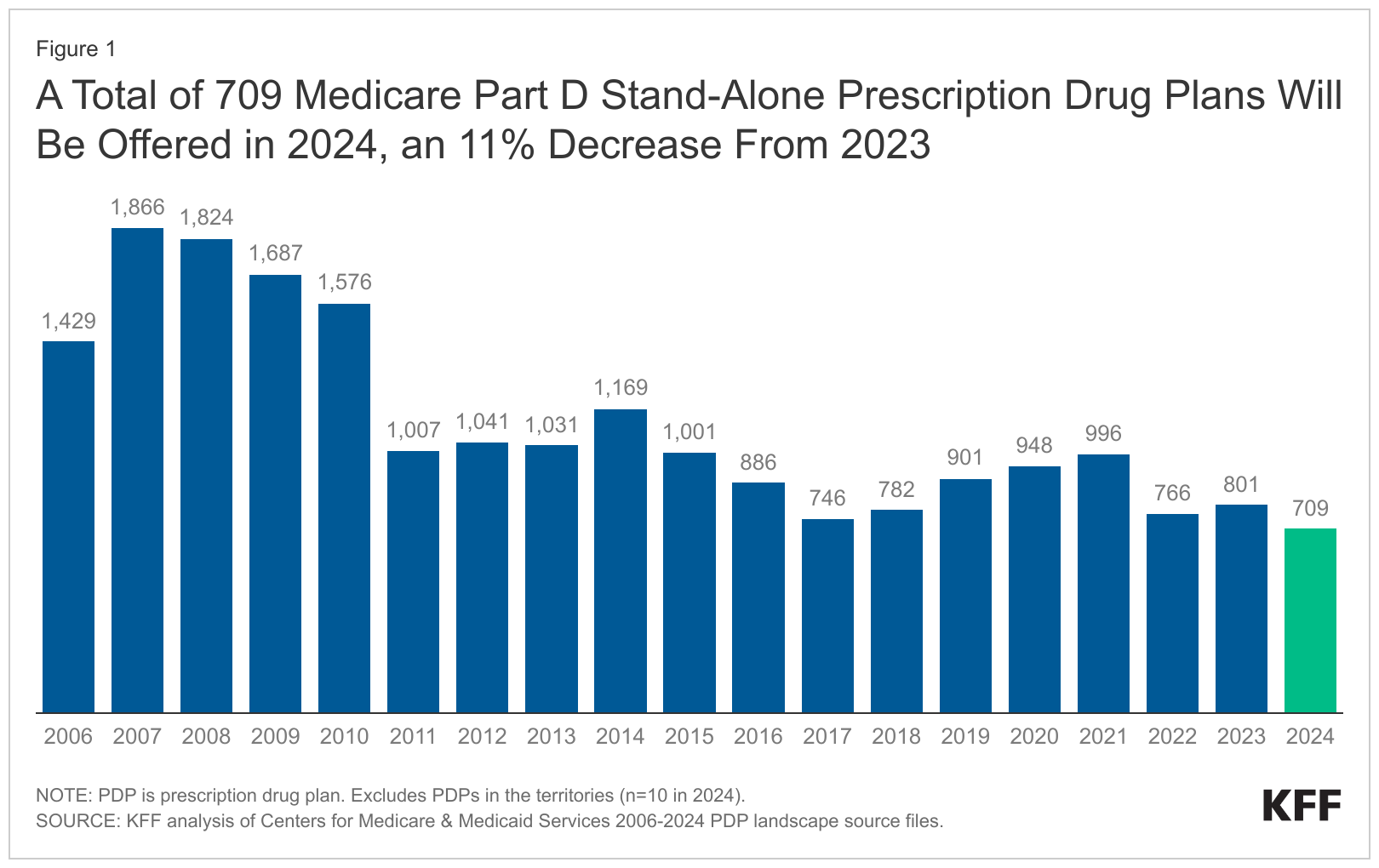

Medicare Part D is the prescription drug coverage component of the Medicare program. It provides coverage for a wide range of prescription medications, helping to offset the often-high costs of prescription drugs. Medicare Part D plans are offered by private insurance companies approved by Medicare, and beneficiaries can choose from various plans with different premiums, deductibles, and copayments.

Can You Decline Medicare Part D?

Yes, you can choose to decline or opt out of Medicare Part D coverage. However, this decision should not be taken lightly, as there are potential consequences and limitations to consider:

-

Late Enrollment Penalty: If you decide to enroll in a Medicare Part D plan later, after initially declining coverage and going without creditable prescription drug coverage for 63 consecutive days or more, you may face a late enrollment penalty. This penalty is calculated as a permanent increase in your monthly Part D premium, and it can add up significantly over time.

-

Gap in Coverage: By declining Medicare Part D, you may experience a gap in your prescription drug coverage, which could result in paying the full cost of your medications out of pocket. This can be particularly challenging for individuals with chronic conditions or those who require multiple medications.

-

Limited Enrollment Periods: If you decline Medicare Part D initially, you will only be able to enroll during specific enrollment periods, such as the annual Open Enrollment Period (October 15th to December 7th) or if you qualify for a Special Enrollment Period (SEP) due to certain life events or changes in circumstances.

When Declining Medicare Part D May Make Sense

While declining Medicare Part D can have consequences, there are certain situations where it may be a viable option:

-

Creditable Prescription Drug Coverage: If you have creditable prescription drug coverage from another source, such as an employer-sponsored plan or a union plan, you may choose to decline Medicare Part D without facing a late enrollment penalty. However, it’s essential to confirm that your existing coverage is creditable and provides coverage that is at least as good as the standard Medicare Part D plan.

-

Limited Prescription Drug Needs: If you have minimal or no prescription drug needs, declining Medicare Part D may be a way to avoid paying the monthly premium. However, it’s important to consider that your healthcare needs can change over time, and enrolling in a Part D plan later may result in a late enrollment penalty.

-

Eligibility for Low-Income Subsidy: If you qualify for the Medicare Low-Income Subsidy (also known as Extra Help), you may not face a late enrollment penalty if you enroll in a Medicare Part D plan later. The Low-Income Subsidy provides financial assistance with Part D premiums and cost-sharing for eligible individuals with limited income and resources.

Making an Informed Decision

Whether to decline Medicare Part D or not is a personal decision that should be based on your specific circumstances, healthcare needs, and financial situation. It’s crucial to weigh the potential risks and consequences against the benefits of having prescription drug coverage.

If you’re unsure about your decision or have questions, it’s recommended to consult with a Medicare advisor, your healthcare provider, or a trusted financial advisor. They can help you understand your options, evaluate your individual needs, and make an informed choice that aligns with your long-term healthcare goals and financial well-being.

When Can I Change My Medicare Part D Plan?

FAQ

What happens if I refuse Medicare Part D?

Can you opt out of Medicare Part D?

Do I really need Medicare Part D?

Is there a penalty for dropping Medicare Part D?