As you approach retirement age, the decision to retire early can be an enticing prospect. However, it’s crucial to understand the potential impact on your National Insurance contributions and future pension benefits. In this comprehensive guide, we’ll dive deep into the nuances surrounding early retirement and National Insurance, equipping you with the knowledge to make an informed decision.

The Importance of Qualifying Years

Your State Pension entitlement is directly tied to the number of qualifying years you’ve accumulated throughout your working life. A qualifying year is a tax year in which you’ve made sufficient National Insurance contributions (NICs) or been credited with them.

To receive the full basic State Pension, you typically need 35 qualifying years for individuals retiring before April 6, 2016, or 35 qualifying years of National Insurance contributions for the new State Pension if retiring after April 6, 2016.

Early Retirement and National Insurance Implications

If you retire before reaching State Pension age, you may need to consider making voluntary National Insurance contributions to ensure you have enough qualifying years to receive your desired State Pension amount. Here’s what you need to know:

-

Fewer Qualifying Years: By retiring early, you’ll have fewer years to accumulate qualifying years through employment and NICs. This could potentially reduce your State Pension entitlement if you don’t have enough qualifying years.

-

Voluntary Contributions: To bridge the gap and boost your qualifying years, you may have the option to make voluntary National Insurance contributions. This can help you reach the required number of qualifying years for a full State Pension.

-

Personal Tax Account: If you have a Personal Tax Account (PTA), you can check your National Insurance record and the number of qualifying years you’ve accrued. This information will help you determine if you need to make voluntary contributions.

-

State Pension Forecast: Alternatively, you can contact the Future Pension Centre and request a State Pension forecast. This will provide you with a clear picture of your current entitlement and whether you need to make additional contributions to achieve your desired State Pension amount.

It’s important to note that the decision to make voluntary National Insurance contributions should be carefully considered, taking into account your overall financial situation and retirement plans.

Early Retirement and Workplace or Personal Pensions

In addition to the State Pension implications, retiring early may also impact your workplace or personal pension benefits. The rules and conditions vary depending on the specific pension scheme, but here are some general considerations:

-

Early Access Restrictions: Some pension schemes may not allow you to access your pension benefits before the normal retirement age specified in the scheme rules.

-

Reduced Pension Amount: If early access is permitted, your pension amount may be reduced to account for the longer period over which the pension will be paid.

-

Ill-Health Provisions: Some schemes may have special provisions that allow for enhanced pension benefits if you retire early due to ill-health or disability.

-

Redundancy Options: If you’re made redundant, you may have the option to delay drawing your pension and allow it to continue growing, or transfer it to a new employer’s pension scheme.

-

Multiple Pensions: If you’ve had several jobs throughout your career, you’ll need to gather information on all your pension rights and entitlements from each scheme.

Given the complexities involved, it’s highly recommended to seek professional advice from a financial advisor or pension specialist. They can help you navigate the specific rules and regulations of your pension schemes and provide tailored guidance based on your unique circumstances.

Making an Informed Decision

Retiring early is a significant life decision that requires careful consideration of various factors, including your financial preparedness, lifestyle goals, and future income needs. By understanding the implications of early retirement on your National Insurance contributions and pension benefits, you’ll be better equipped to make an informed choice that aligns with your retirement aspirations.

Remember, proactive planning and seeking professional guidance can help ensure a smooth transition into retirement, minimizing potential pitfalls and maximizing your financial security in the golden years ahead.

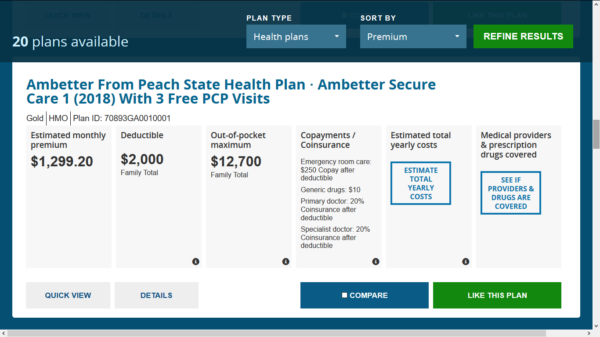

Retiring early: How much your health insurance will cost

FAQ

What happens if I decide to retire early?

What happens if you stop working before retirement age?

How early can you retire without penalty?