When it comes to choosing a health insurance plan, the options can be overwhelming. Two common types of plans are Exclusive Provider Organizations (EPOs) and Preferred Provider Organizations (PPOs). While both offer access to provider networks, there are significant differences in how they operate and the level of coverage they provide. In this article, we’ll break down the key distinctions between EPOs and PPOs to help you make an informed decision.

What is an EPO (Exclusive Provider Organization)?

An EPO is a type of managed care health insurance plan that provides coverage exclusively through a network of contracted healthcare providers, including doctors, hospitals, and other medical facilities. Here are some key features of an EPO plan:

- Exclusive Network: EPOs have a limited network of providers that you must use to receive coverage for non-emergency care. If you go outside the network, except in cases of emergency, you’ll typically have to pay the full cost of services.

- No Out-of-Network Coverage: Unlike PPOs, EPOs generally do not cover any costs for out-of-network providers, except in emergencies.

- No Need for Referrals: Like PPOs, you don’t need a referral from a primary care physician (PCP) to see a specialist within the network.

- Lower Premiums: EPO plans often have lower monthly premiums compared to PPOs because of their restricted provider networks.

What is a PPO (Preferred Provider Organization)?

A PPO is another type of managed care health insurance plan that provides coverage through a network of preferred healthcare providers. However, PPOs offer more flexibility than EPOs when it comes to out-of-network coverage. Here are some key features of a PPO plan:

- Larger Network: PPOs typically have a broader network of providers compared to EPOs, giving you more choices for healthcare services.

- Out-of-Network Coverage: While you’ll pay more out-of-pocket for out-of-network providers, PPOs offer some level of coverage for services received outside their network.

- No Need for Referrals: Like EPOs, you don’t need a referral from a PCP to see a specialist within the network.

- Higher Premiums: PPO plans generally have higher monthly premiums than EPOs due to the increased flexibility and broader provider networks.

Key Differences Between EPOs and PPOs

To summarize the main differences between EPOs and PPOs:

| Feature | EPO | PPO |

|---|---|---|

| Provider Network | Exclusive network | Larger network with out-of-network coverage |

| Out-of-Network Coverage | Generally not covered (except emergencies) | Covered at a higher cost |

| Referrals Needed | No | No |

| Monthly Premiums | Lower | Higher |

| Out-of-Pocket Costs | Lower for in-network services | Higher for out-of-network services |

Which Plan is Right for You?

Choosing between an EPO and a PPO plan ultimately depends on your healthcare needs, budget, and preferences. Here are some factors to consider:

- Access to Providers: If you have preferred healthcare providers outside the EPO network, a PPO might be a better choice to ensure coverage for their services.

- Flexibility: PPOs offer more flexibility in terms of out-of-network coverage, which can be beneficial if you travel frequently or need specialized care not available within the network.

- Cost: EPOs generally have lower premiums and out-of-pocket costs for in-network services, making them a more budget-friendly option for those willing to stick to the plan’s network.

- Predictability: With an EPO, you know exactly what you’ll pay for in-network services, as there’s no out-of-network coverage (except in emergencies). This can make budgeting for healthcare expenses easier.

It’s important to carefully review the provider networks, coverage details, and costs associated with each plan option before making your decision.

Final Thoughts

While EPOs and PPOs share some similarities, such as not requiring referrals for specialist visits, they differ significantly in terms of provider networks, out-of-network coverage, and overall costs. EPOs offer a more restrictive but often less expensive option, while PPOs provide greater flexibility with a larger network and out-of-network coverage, typically at a higher premium. By understanding these key differences, you can make an informed choice that aligns with your healthcare needs and budget.

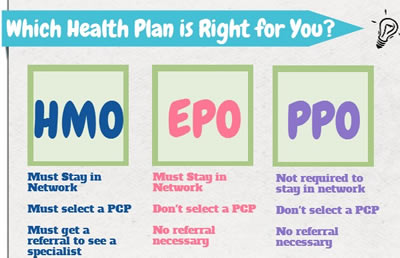

What is an HMO, PPO, HDHP or EPO

FAQ

Is it better to get EPO or PPO?

What are the disadvantages of EPO health insurance?

What does EPO mean for health insurance?

What is the biggest difference between HMO EPO PPO and POS healthcare plans?