As we navigate through the different stages of life, one question that often arises is whether life insurance premiums increase as we age. The short answer is yes, life insurance rates tend to go up as you get older. However, understanding the reasons behind this trend and the factors that influence premium costs can help you make informed decisions about securing adequate coverage at different life stages.

The Age Factor: Why Premiums Climb with Age

Life insurance companies base their premium calculations on a variety of factors, with age being a crucial determinant. The primary reason why life insurance rates increase with age is directly linked to the increased risk of mortality as we grow older.

Insurance companies use actuarial data and statistical models to assess the likelihood of an individual passing away during a specific period. As we age, our life expectancy decreases, and the probability of experiencing health complications or chronic conditions increases. Consequently, the risk of the insurance company having to pay out a death benefit rises, which is reflected in higher premium costs.

The Impact of Age on Life Insurance Rates

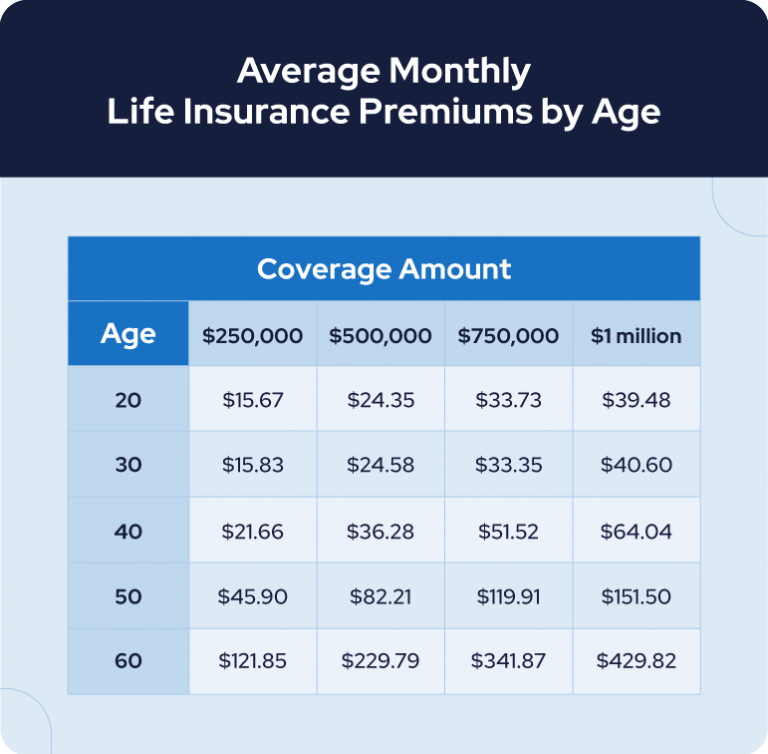

To illustrate the impact of age on life insurance rates, let’s consider the following example:

John, a non-smoker in excellent health, purchases a 20-year term life insurance policy with a $500,000 death benefit at the age of 30. His monthly premium might be around $25.

If John waits until he’s 40 years old to purchase the same policy, his monthly premium could be closer to $40, reflecting the increased risk associated with his age.

And if he delays even further until age 50, the monthly premium for the same coverage could potentially exceed $100, significantly higher than what he would have paid at a younger age.

It’s important to note that while age is a significant factor, it is not the only one that determines life insurance rates. Other factors such as health status, lifestyle choices (e.g., smoking), family medical history, and the type of policy (term or permanent) also play a role in calculating premiums.

Mitigating the Impact of Age on Life Insurance Rates

While age-related premium increases are inevitable, there are strategies you can employ to minimize the impact:

-

Purchase Coverage Early: The earlier you secure life insurance coverage, the lower your premiums will be. Many experts recommend obtaining a policy in your 20s or 30s when rates are typically at their most affordable.

-

Maintain a Healthy Lifestyle: Engaging in regular exercise, maintaining a balanced diet, and avoiding harmful habits like smoking can positively influence your health classification and potentially lower your premiums.

-

Consider Term Life Insurance: Term life insurance policies, which provide coverage for a specific period (e.g., 10, 20, or 30 years), tend to be more affordable than permanent life insurance, especially at younger ages.

-

Review and Adjust Coverage Regularly: As your life circumstances change (e.g., marriage, children, mortgage), it’s advisable to review your life insurance coverage and make adjustments as needed to ensure adequate protection without overpaying.

-

Explore Renewal Options: Some term life insurance policies offer the option to renew coverage at the end of the term, potentially at a lower rate than purchasing a new policy at an older age.

Remember, life insurance is an essential component of financial planning, providing peace of mind and protection for your loved ones in the event of your untimely passing. While age-related premium increases are unavoidable, understanding the factors that influence rates can help you make informed decisions and secure the coverage you need at different stages of your life.

How Life Insurance Providers Are Screwing You Over! – Dave Ramsey Rant

FAQ

Does term life insurance get more expensive as you get older?

At what age do life insurance premiums increase?

Do life insurance policies increase in value over time?

Why does my life insurance keep going up?