As a Medicare beneficiary, it’s crucial to understand how your income affects the premiums you pay for Medicare Part B and prescription drug coverage. The Centers for Medicare & Medicaid Services (CMS) and the Social Security Administration (SSA) use a specific income measure to determine if you’ll pay higher premiums – and that measure is your “modified adjusted gross income” (MAGI). In this article, we’ll dive into what MAGI is and how it’s used to calculate your Medicare premiums for the year 2021.

What is Modified Adjusted Gross Income (MAGI)?

MAGI is a term used by the Internal Revenue Service (IRS) to determine your eligibility for certain tax benefits and credits. It’s calculated by taking your Adjusted Gross Income (AGI) from your tax return and adding back certain deductions and exclusions, such as:

- Student loan interest deduction

- Tuition and fees deduction

- Foreign earned income exclusion

- Foreign housing exclusion or deduction

- Exclusion of qualified savings bond interest

- Adoption expenses

In simpler terms, MAGI is your total AGI plus any tax-exempt interest income you may have received.

How MAGI Determines Your Medicare Premiums

The SSA uses your MAGI from your most recent tax return (generally from two years prior) to calculate your income-related monthly adjustment amounts for Medicare Part B and prescription drug coverage.

If your MAGI exceeds certain thresholds, you’ll pay a higher monthly premium for Medicare Part B and an additional amount for your Medicare prescription drug coverage. The higher your MAGI, the higher your premium adjustments will be.

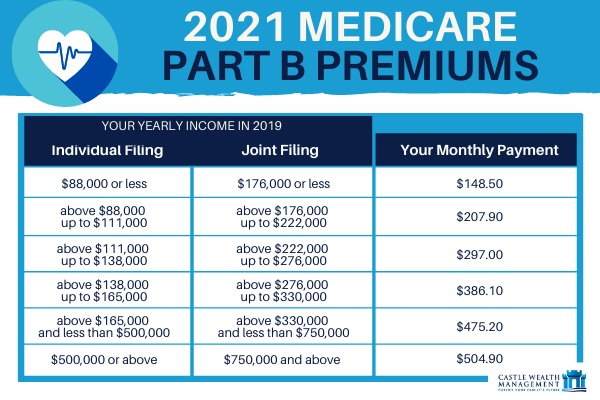

Here are the MAGI thresholds and corresponding Part B and prescription drug coverage premium adjustments for 2021:

For Individual Tax Filers

| MAGI | Part B Monthly Premium | Prescription Drug Coverage Monthly Premium |

|---|---|---|

| ≤ $88,000 | $148.50 (standard) | Your plan premium |

| $88,001 – $111,000 | $207.90 | Your plan premium + $12.30 |

| $111,001 – $138,000 | $297.00 | Your plan premium + $31.80 |

| $138,001 – $165,000 | $386.10 | Your plan premium + $51.20 |

| $165,001 – $500,000 | $475.20 | Your plan premium + $70.70 |

| ≥ $500,000 | $504.90 | Your plan premium + $77.10 |

For Joint Tax Filers

| MAGI | Part B Monthly Premium | Prescription Drug Coverage Monthly Premium |

|---|---|---|

| ≤ $176,000 | $148.50 (standard) | Your plan premium |

| $176,001 – $222,000 | $207.90 | Your plan premium + $12.30 |

| $222,001 – $276,000 | $297.00 | Your plan premium + $31.80 |

| $276,001 – $330,000 | $386.10 | Your plan premium + $51.20 |

| $330,001 – $750,000 | $475.20 | Your plan premium + $70.70 |

| ≥ $750,000 | $504.90 | Your plan premium + $77.10 |

If you’re married but filed a separate tax return from your spouse and lived with your spouse at some point during the taxable year, different thresholds apply.

Appealing Your Income-Related Adjustment Amount

If you disagree with the income-related adjustment amount determined by the SSA, you have the right to appeal the decision. You can request a new decision if your income has gone down due to certain life-changing events, such as:

- Marriage, divorce, or death of a spouse

- Loss of income-producing property

- Cessation or termination of an employer’s pension plan

- Settlement from an employer due to closure, bankruptcy, or reorganization

To request a new decision, you’ll need to provide documentation verifying the event and the reduction in your income, such as a death certificate, a letter from your employer, or your signed federal income tax return for the year in question.

Conclusion

Understanding how your MAGI affects your Medicare premiums is crucial for budgeting and planning your healthcare expenses. By staying informed about the income thresholds and premium adjustments, you can make informed decisions about your Medicare coverage and appeal any adjustments that you believe are incorrect or no longer reflect your current financial situation.

Remember, the SSA uses your most recent tax return information available from the IRS, typically from two years prior, to calculate your MAGI and determine your income-related adjustments. If your income has changed significantly since then, you may be eligible for a new decision and potentially lower premiums.

2021 Medicare Costs and Premiums

FAQ

What income is considered for Medicare premiums?

What income level triggers higher Medicare premiums?

What are the Medicare income brackets for 2021?

|

IRMAA Table

|

2021

|

|

More than $111,000 but less than or equal to $138,000

|

$297.00

|

|

More than $138,000 but less than or equal to $165,000

|

$386.10

|

|

More than $165,000 but less than $500,000

|

$475.20

|

|

More than $500,000

|

$504.90

|

What income is used to determine Medicare premiums 2025?