When it comes to protecting your hard-earned savings, having a substantial amount of money in the bank can be both a blessing and a source of concern. While most bank accounts are insured up to a certain limit, those with excess deposits may need to explore additional options to ensure their funds are fully protected. In this article, we’ll delve into various strategies to insure over $2 million in the bank, empowering you to safeguard your wealth with confidence.

Understanding FDIC Insurance Limits

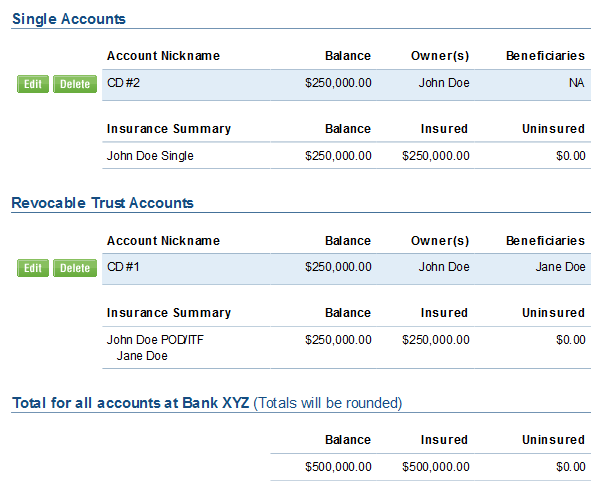

The Federal Deposit Insurance Corporation (FDIC) is a government agency that provides insurance coverage for depositors in FDIC-insured banks. Currently, the FDIC insures deposits up to $250,000 per depositor, per insured bank, for each account ownership category.

Account ownership categories are essential in determining your insurance coverage. The most common categories include:

- Single accounts (owned by one person)

- Joint accounts (owned by two or more individuals)

- Certain retirement accounts (such as IRAs and Keogh plans)

- Revocable and irrevocable trust accounts

- Business accounts (corporations, partnerships, and unincorporated associations)

It’s crucial to understand that the $250,000 limit applies to each account ownership category at each insured bank. This means that if you have multiple accounts with different ownership categories at the same bank, each account may be insured up to $250,000, potentially increasing your overall coverage.

Strategies to Insure Over $2 Million

While the FDIC insurance limit provides a safety net for many depositors, those with excess deposits may need to explore additional strategies to ensure their funds are fully protected. Here are some effective methods to consider:

-

Utilize Bank Networks

- Bank networks, such as the IntraFi Network Deposits and the Impact Deposits Corp., can help you spread your excess deposits across multiple FDIC-insured banks, effectively expanding your insurance coverage.

- These networks distribute your funds among various member banks, allowing you to maintain a single account while benefiting from the combined insurance coverage of multiple institutions.

-

Open Accounts with Different Ownership Categories

- As mentioned earlier, each account ownership category is insured separately up to $250,000 per insured bank.

- By opening accounts with different ownership categories, such as joint accounts, revocable trusts, or business accounts, you can maximize your insurance coverage at a single bank.

- For example, if you have $500,000 in a single account, you could open a joint account with your spouse, providing an additional $250,000 in coverage per co-owner.

-

Diversify Across Multiple Banks

- Another effective strategy is to open accounts at several FDIC-insured banks, allowing you to benefit from the $250,000 coverage at each institution.

- This approach requires diligent account management and record-keeping, but it can significantly increase your overall insurance coverage.

- Consider using online banking platforms or financial management tools to streamline the process of managing multiple accounts across different banks.

-

Utilize Brokerage Accounts

- Many brokerage firms, such as Fidelity Investments and Charles Schwab, offer access to FDIC-insured certificates of deposit (CDs) from various banks across the country.

- By diversifying your CD investments across multiple banks through a brokerage account, you can potentially expand your insurance coverage beyond the limits of a single institution.

- However, it’s essential to carefully monitor your investments to ensure compliance with FDIC insurance regulations and limits.

-

Explore Credit Union Options

- Credit unions offer an alternative to traditional banks and are insured by the National Credit Union Share Insurance Fund (NCUSIF), which provides similar coverage to the FDIC.

- The NCUSIF insures individual deposit accounts up to $250,000, including specific account categories like IRAs and trust accounts.

- To open an account at a credit union, you typically need to meet membership requirements, which are often more lenient than those of traditional banks.

-

Consider Specialized Bank Offerings

- Some banks offer specialized services designed to increase insurance coverage for high-net-worth individuals and businesses.

- For example, Wintrust Financial’s MaxSafe account allows individuals to insure up to $3.75 million by spreading their deposits across multiple separately chartered banks within the Wintrust network.

- These specialized offerings often provide consolidated account statements and tax reporting, simplifying the management of multiple accounts.

-

Consult with Financial Advisors

- Navigating the complexities of insuring excess deposits can be challenging, and seeking professional guidance from financial advisors or wealth managers can be beneficial.

- These experts can provide tailored advice based on your specific financial situation, risk tolerance, and investment objectives, ensuring that your funds are adequately protected while aligning with your overall financial goals.

Conclusion

Insuring over $2 million in the bank requires a strategic approach and a thorough understanding of the available options. By leveraging bank networks, diversifying across multiple institutions, exploring specialized bank offerings, and seeking professional guidance, you can effectively safeguard your excess deposits and enjoy peace of mind knowing your hard-earned wealth is secure. Remember, diligent planning and proactive measures are key to protecting your financial future.

$3.5 Million FDIC Insured at One Bank? It’s Possible.

FAQ

Where do millionaires keep their money if banks only insure 250k?

Do banks insure millions?

Is it safe to keep a million dollars in the bank?