As you approach retirement age and start exploring your healthcare options, understanding the intricacies of Medicare can be overwhelming. Two terms that often cause confusion are “Medicare Part B” and “Medigap.” While they seem similar, they serve distinct purposes in the Medicare landscape. In this comprehensive guide, we’ll dive deep into the differences between these two essential components, empowering you to make informed decisions about your healthcare coverage.

Medicare Part B: The Cornerstone of Outpatient Coverage

Medicare Part B is one of the fundamental components of Original Medicare, the government-run healthcare program for individuals aged 65 and older or those with certain disabilities. Part B is designed to cover a wide range of outpatient services, including:

- Doctor visits

- Preventive care services

- Outpatient procedures

- Diagnostic tests

- Durable medical equipment

- Mental health services

In essence, Medicare Part B serves as a critical safety net, ensuring that you have access to essential medical care outside of the hospital setting. However, it’s important to note that Part B does not cover everything, and you may still be responsible for deductibles, coinsurance, and copayments for certain services.

Medigap: Filling the Gaps in Original Medicare

Medigap, also known as Medicare Supplement Insurance, is a private insurance policy designed to work alongside Original Medicare (Parts A and B). Its primary purpose is to help cover the out-of-pocket costs that Original Medicare doesn’t cover, such as deductibles, coinsurance, and copayments.

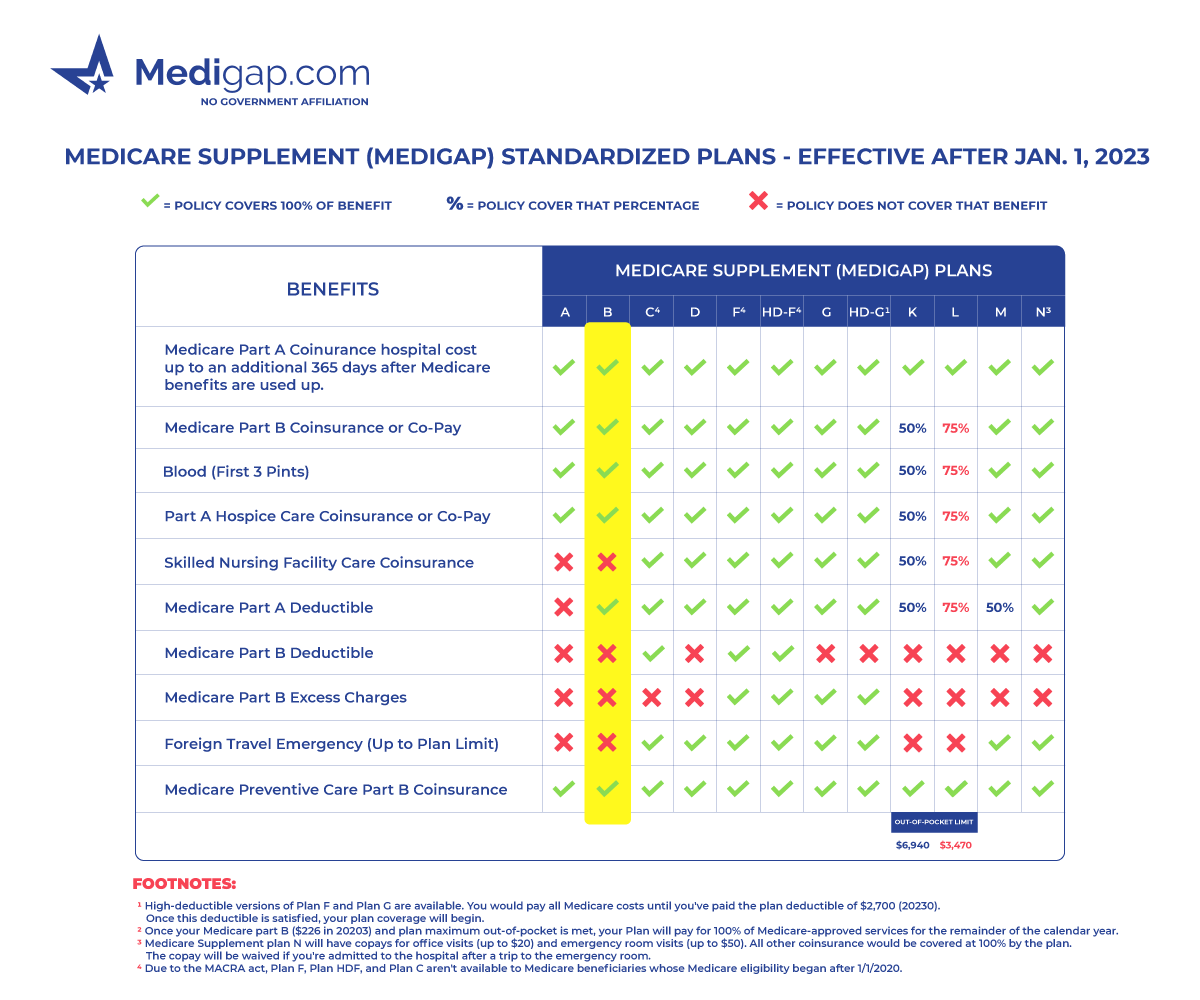

There are several standardized Medigap plans available, each offering different levels of coverage. These plans are identified by letters (e.g., Plan A, Plan B, Plan G), and the benefits vary from plan to plan. Some of the most common expenses that Medigap policies cover include:

- Medicare Part A coinsurance and hospital costs

- Medicare Part B coinsurance or copayments

- Blood (first three pints)

- Part A hospice care coinsurance or copayments

- Skilled nursing facility care coinsurance

It’s important to note that Medigap plans do not provide prescription drug coverage, which is offered through a separate Medicare Part D plan.

The Crucial Distinction: Separate but Complementary

While Medicare Part B and Medigap may seem similar at first glance, they serve distinct purposes and cannot be used interchangeably. Here’s a breakdown of the key differences:

-

Purpose: Medicare Part B is a core component of Original Medicare, providing outpatient medical coverage. Medigap, on the other hand, is a supplemental insurance policy designed to fill the gaps in Original Medicare coverage.

-

Coverage: Medicare Part B covers outpatient services, while Medigap helps pay for some of the out-of-pocket costs associated with both Parts A and B of Original Medicare.

-

Enrollment: You must enroll in Medicare Part B to receive outpatient coverage. Medigap plans are offered by private insurance companies, and enrollment is separate from Medicare Part B.

-

Costs: Medicare Part B has a monthly premium, an annual deductible, and coinsurance or copayments. Medigap plans have their own separate premiums, which vary depending on the plan and insurance company.

It’s crucial to understand that Medigap plans are not replacements for Medicare Part B. Instead, they work in tandem with Original Medicare (Parts A and B) to provide more comprehensive coverage and reduce your out-of-pocket expenses.

Making the Right Choice for Your Healthcare Needs

Navigating the complexities of Medicare can be daunting, but understanding the differences between Medicare Part B and Medigap is a crucial step in ensuring you have the coverage you need. While Part B provides essential outpatient coverage, a Medigap plan can help alleviate some of the financial burdens associated with Original Medicare.

As you explore your options, it’s essential to consider your specific healthcare needs, budget, and lifestyle. Working with a licensed insurance agent or a trusted healthcare professional can help you evaluate the different Medigap plans available and determine which one best complements your Medicare Part B coverage.

Remember, healthcare is a significant investment, and making informed decisions about your coverage can not only provide peace of mind but also protect your financial well-being in the long run.

Medicare-Explained Parts A & B (Advantage vs Supplement)

FAQ

What is Medicare Part B also known as?

Is there a Medicare supplement that covers everything?

Do you need Medicare Part B if you have private insurance?

What is the most popular supplement plan for Medicare?