Paying bills can be a tedious task. Every month, it takes a lot of time to look for statements, log in to multiple websites, fill out payment information, and buy stamps. Because of this, a lot of people are using online bill payment services from banks and credit unions. A bill pay service lets you see your bills, set up payments, and handle everything from one place.

One popular bill pay option comes from Orange County’s Credit Union. I’ve been using their service for awhile now and want to share my experience in this article. Below I’ll cover how it works, top features, and reasons why Orange County’s Credit Union’s bill pay is worth considering.

What is Orange County’s Credit Union Bill Pay?

Orange County’s Credit Union Bill Pay is an online service that lets members securely pay bills from their checking account. After signing up you can add payees like utility companies mortgage servicers, insurance providers, etc. The bill pay system stores your information so you don’t have to re-enter it every time.

Just choose the person you want to pay, enter the amount you owe, and choose a delivery date to pay the bill. Payments can be sent electronically or by paper check. If a business doesn’t accept electronic payments, Orange County’s Credit Union will print and mail a check for you.

Bill pay is accessible through Orange County’s Credit Union’s online and mobile banking. So you can schedule payments from your computer or phone. It’s free for members to use.

Top Features of Orange County’s Credit Union Bill Pay

Orange County’s Credit Union packs their bill pay service with useful features that make managing bills a breeze:

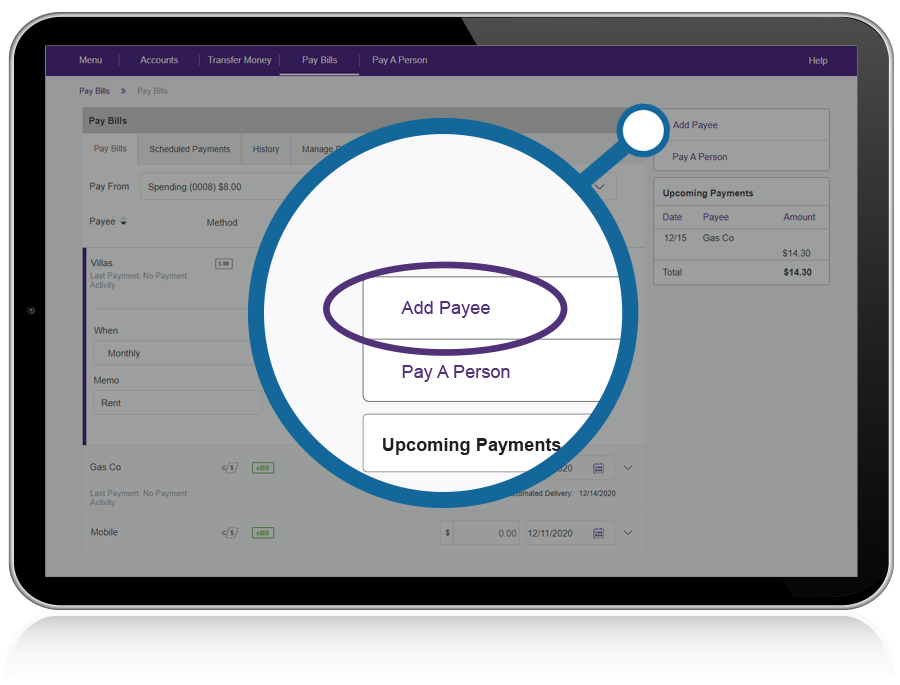

Add Payees Easily – Adding a new payee takes just seconds. Enter the name, address, account number, and any other info once. The payee is stored for future bills.

Schedule Recurring Payments – For bills that are the same each month like cable or gym dues, you can set up recurring payments. The system automatically sends the payment on the date you specify so you don’t have to remember to do it manually.

Get eBills – Many major companies let you receive bills electronically through Orange County’s Credit Union. Instead of waiting for a paper statement, eBills are delivered directly to your bill pay account.

Set Up Automatic Payments – Combine recurring payments and eBills to completely automate bill management Establish rules like “Pay credit card statement balance in full 5 days after eBill received”.

Mobile Access – The bill pay app lets you pay bills on-the-go. See what’s coming up, approve payments, add payees, and more.

Payment History – Your bill payment history is stored securely so you can look back any time. Easily check if a bill was paid or find payment confirmation numbers.

Check vs Electronic Payments – For payees who don’t accept electronic payments, Orange County’s Credit Union prints and mails a paper check on your behalf. You can tell which type of payment will be used based on the icons shown.

Upcoming Payments – A convenient snapshot shows payments scheduled to be sent out soon. Use it to check if any pending bills slipped your mind.

Multiple Checking Accounts – If you have more than one checking account with Orange County’s Credit Union, you can seamlessly switch between them when making payments.

Why Use Orange County’s Credit Union for Bill Pay?

Here are some of the biggest reasons I recommend Orange County’s Credit Union for managing bill payments:

It’s Free – Bill pay is included at no extra cost for Orange County’s Credit Union members. Many banks charge monthly fees for bill pay, even just to use basic features.

Top Security – Orange County’s Credit Union uses advanced security measures like multi-factor authentication and data encryption. So you can pay bills with confidence knowing your info is protected.

Credit Union Benefits – As a member, you become an owner of this nonprofit cooperative. Orange County’s Credit Union focuses on great service and products for members, not profits like big banks.

Local Service – With branches and ATMs throughout Orange County, you can easily handle any bill pay questions in person. Talk to knowledgeable staff right in your community.

High Ratings – Orange County’s Credit Union consistently earns 5-star ratings for member satisfaction. Users praise their helpful service, online/mobile experience, rates, and more.

Established History – Founded in 1938, Orange County’s Credit Union has 85+ years of experience in consumer financial services. They offer stable, reliable products that are refined over decades of learning members’ needs.

Integration – Bill pay integrates directly with Orange County’s Credit Union online and mobile banking. You don’t have to deal with another app or remember extra passwords. Everything related to your accounts is unified for smooth access.

How to Sign Up for Bill Pay

Ready to consolidate your monthly bills? Signing up for Orange County’s Credit Union Bill Pay is easy:

Step 1: Become a Member – You need to open a checking account with Orange County’s Credit Union first. Eligibility is open to those who live, work, or worship in Orange County. Joining only takes a few minutes.

Step 2: Enroll in Online Banking – Bill pay is accessible through online and mobile banking. So make sure you register your new account for digital access during the joining process.

Step 3: Access Bill Pay – Once logged into your online account, click on the Bill Pay tab. Follow the prompts to get enrolled in the system.

Step 4: Add Payees – Search for companies you want to pay and enter details like account numbers. Add as many payees as you need – common ones include credit cards, utilities, loans, etc.

Step 5: Schedule Payments – Pick a payee, date, amount, and delivery method each time you have a bill to pay. Set up automatic recurring payments for regular monthly bills.

And that’s it! With bill pay set up, you can manage all payments from one dashboard. Payments are delivered on time and your payment history is securely stored. Let Orange County’s Credit Union make bill pay something you no longer have to dread each month.

Try Out Orange County’s Credit Union Bill Pay

As you can see, Orange County’s Credit Union offers a full-featured bill payment service for members. It has helpful capabilities that simplify the tedious task of paying monthly bills. And best of all – it’s totally free!

I’m glad I switched to using Orange County’s Credit Union Bill Pay. It saves me time not having to deal with paper bills and stamps. I have peace of mind knowing recurring payments happen automatically. And I feel good supporting this local credit union that provides great service to the Orange County community.

Itâs great…. when it actually works

The developer, Orange Countys Credit Union, indicated that the appâs privacy practices may include handling of data as described below. For more information, see the developerâs privacy policy.

Whatâs New May 14, 2024

Various bugs and security issues resolved

Orange County’s Credit Union – Mobile Banking

FAQ

How to pay credit card bill orange county credit union?

How do I pay money into my credit union account?

What is the routing number for Orange County credit union?

Is Orange County credit union FDIC insured?

Does Orange County credit union offer free bill payment?

With free Bill Payment from Orange County’s Credit Union, you can safely issue payments to all of your billers directly from your checking account. There’s no need to visit each individual company’s website. Even better, there’s no reason to spend valuable time waiting for the mail just to send a handwritten check – likely at your own expense.

Does Orange County have a credit union?

Orange County’s Credit Union services include checking and savings, mobile banking, and retirement accounts, as well as auto, small business, and home loans with mortgage offerings including Zero Down and 3% Down options. Membership is open to anyone who lives or works in Orange, Los Angeles, Riverside, and San Bernardino Counties, CA.

Does Orange County have online banking?

Orange County’s Credit Union Online Banking and Mobile Banking offer everything you need to bank wherever you are. View your account info, move money, deposits checks, pay bills, send money to friends, freeze and unfreeze your debit card, find ATMs, and more with ease and security. iPhone and Android Apps are available too.

How do I transfer money from Orange County credit union?

Save our number, 696228, to your contacts to easily identify our texts. Schedule one-time or recurring transfers to move your money for you. Add memos to your transfers to keep track of what they’re for. Transfer money back and forth between your accounts at Orange County’s Credit Union and other banks.