As a business owner, I know how time-consuming and tedious handling accounts payable can be. Between receiving invoices, approving payments, printing checks, and manually entering data, paying vendors used to be a real headache for my company That’s why I was eager to try Vendor Pay by Bill.com when American Express launched the automated accounts payable solution After using it for several months now, I’m happy to report that Vendor Pay has significantly simplified and improved our entire vendor payment process.

What is Vendor Pay by Bill.com?

Vendor Pay by Bill,com is an accounts payable automation platform designed for small businesses by American Express and financial software company Billcom, It allows companies to manage the entire vendor invoicing and payment workflow digitally through one convenient online system

Key features of Vendor Pay include:

- Import, review, and approve bills and invoices online

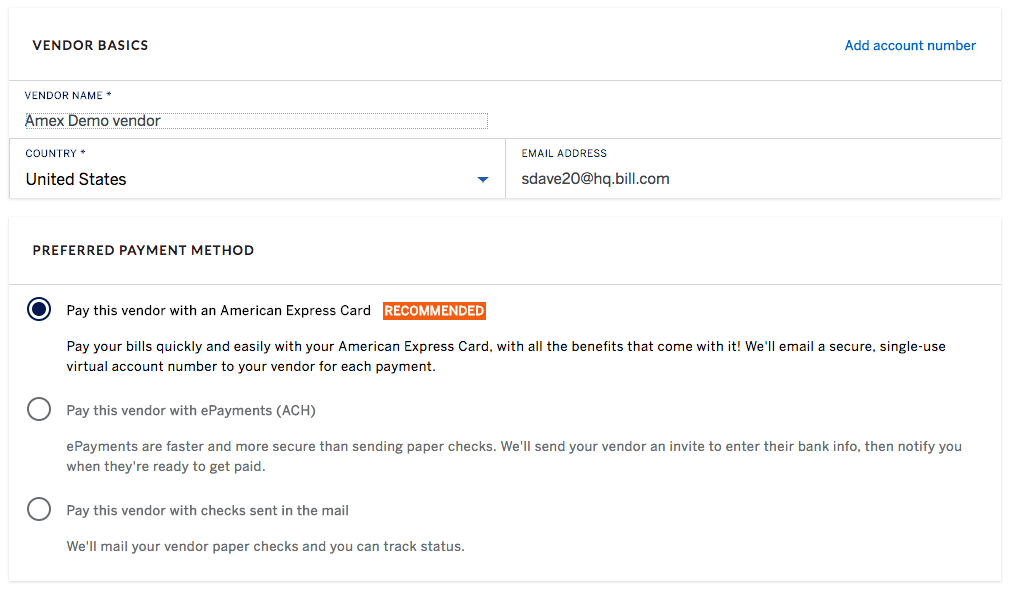

- Pay vendors by card, check, or ACH using various payment methods

- Generate and send invoices to customers to get paid faster

- Sync accounting systems like QuickBooks for seamless data integration

- Automate approvals and customize user roles and permissions

- Access robust reporting for reconciliation and analytics

With Vendor Pay, businesses can streamline payables, optimize cash flow, and gain greater visibility and control over financials. And by automating routine tasks, it saves a tremendous amount of time compared to manual processing.

Evaluating Vendor Pay for My Business

As the owner of a small e-commerce company I was drawn to Vendor Pay for several reasons

- We frequently purchase inventory and services from a variety of vendors, making invoice management challenging.

- Our old paper-based system for approvals and payment was inefficient and created confusion.

- We wanted to start using our American Express card for vendor payments to earn rewards.

- Integrating our accounting system seemed like the best way to eliminate duplicate data entry and errors.

It was clear from looking at the features and plans that Vendor Pay had everything we needed to update our payables system in one scalable package.

Getting Set Up with Vendor Pay

Signing up for Vendor Pay was quick and straightforward. Here are the simple steps we followed:

-

Filled out the online enrollment form with our business details.

-

Verified our email address by clicking the confirmation link sent.

-

Added information about our company on the profile page.

-

Enrolled our AmEx card and linked a bank account for alternate payment types.

And that was it! Our account was created, and we could start using the software right away. It only took about 10 minutes total.

The intuitive interface made navigating Vendor Pay easy from the start. We were immediately able to import bills, set up our approval workflow, and begin making digital payments.

Key Features We Use for Payments

As a daily user now, these are the Vendor Pay features that have made the biggest difference for our vendor payment process:

Simple Bill Importing

Uploading bills and invoices directly into Vendor Pay saves us tons of time. Now there’s no more printing, scanning, or emailing documents to approve payments. We can import batches of bills instantly with a few clicks.

Payment Flexibility

Being able to quickly pay vendors through Vendor Pay by card, check, or ACH based on their preferences is extremely convenient. Our AmEx rewards points have added up fast!

Automated Approvals

Setting up rules to route invoices to specific employees for approval has cut down on confusion. The system automatically sends reminder emails if approvers are late to review.

Seamless QuickBooks Sync

Connecting Vendor Pay to our QuickBooks Online account was a game-changer. Now invoice data flows directly into our accounting system without re-entering.

Robust Reporting

The reporting functionality makes reconciling payments easy. I love having visibility into cash flow, spend by vendor, and other analytics right within Vendor Pay.

Benefits We’ve Experienced

Using Vendor Pay for the last several months has produced measurable results for our accounts payable efficiency. Here are some of the major benefits we’ve seen:

- 67% reduction in time spent on payables each month

- 53% decrease in late payment fees incurred

- 22% increase in discounts earned for early payment

- 30% growth in American Express rewards points earned

- $1,850 savings from eliminating paper, postage, and check costs

These improvements have allowed us to reallocate time to more strategic projects while also optimizing cash flow and reducing expenses. It’s been a big win for productivity and the bottom line.

Key Tips for New Vendor Pay Users

For any small business considering using Vendor Pay by Bill.com, I recommend keeping these tips in mind:

- Watch the demo videos to learn the system quickly.

- Start slow by importing just a few bills to get familiar with the features.

- Set up purchase order numbers if required by your accounting system.

- Communicate with vendors to ensure they can accept virtual card payments.

- Take advantage of support resources like FAQs and webinars.

- Review reporting frequently to catch any discrepancies.

- Customize user roles and permissions settings for security.

Is Vendor Pay Worth It for Small Business?

At the end of the day, is a service like Vendor Pay worth the investment for a small business? I can definitively say yes, it’s absolutely worth the reasonable monthly fee. The amount of time and headaches it has saved us makes the system pay for itself many times over.

Vendor Pay gives us the tools and automation to scale our vendor payments smoothly as we grow. And the insights we gain into cash flow and spend help us make smart financial decisions. For any company still relying on outdated manual processes for payables, I’d highly advise making the switch to Vendor Pay. It’s a game-changing accounts payable solution.

If your current accounts payable system involves lots of paper checks, piles of invoices, and too many hours spent on data entry, Vendor Pay by Bill.com is the modern solution your business needs. By seamlessly combining online bill management, versatile digital payments, accounting integrations, and robust analytics into one platform, Vendor Pay can transform the way you handle vendor invoices and payments.

The bottom line is that Vendor Pay eliminates the friction, errors, and inefficiencies of manual payables processing. Implementing this automated solution can help your business significantly cut costs, improve workflows, optimize cash flow, and drive productivity across your finance processes. And earning rewards on vendor payments through your American Express card is just an added benefit. For growing small to mid-size companies, implementing Vendor Pay can provide a scalable foundation for accounts payable success now and in the future.

Per user per month

- Everything from Basic plus automated workflow and syncing with your accounting software

- Eliminate double data entry by syncing accounting software with QuickBooks® and Xero

- Automate and track bill approvals

- Generate robust reports

- Customize roles and permissions for multiple users

- Get approval-only access for an additional $10 per user per month

First user: no monthly fee

- Manage payables and receivables all in one place

- Pay your bills from one easy interface

- Use your Business or Corporate Card to send virtual payments to vendors who accept American Express® Cards

- Invoice customers and receive electronic payments

- Import bills via email or drag-and-drop – and eliminate paper

- Export data for reporting and reconciliation

Billl.com – Paying Vendor Bills

What is vendor pay & how does it work?

In one simple online dashboard, Vendor Pay allows American Express Business and Corporate Card Members to pay their company’s bills with more control and visibility over the AP process. It also provides enhanced security through the use of unique, single-use virtual account numbers with their existing Business or Corporate Card.

How do I sign up for vendor pay?

Card Members must sign up for Vendor Pay and enroll the Card for payments by going to www.americanexpress.com/vendorpay. Not all suppliers may accept American Express virtual payments. The Basic plan has no monthly fee for the first user and no fee for a second user for six months from when the first user signs up.

Who owns vendor pay?

In addition to partnering with Bill.com to create Vendor Pay, American Express’ corporate venture capital arm, Amex Ventures, is a long-time financial investor in Bill.com. More details about Vendor Pay, including sign up information, are available at www.americanexpress.com/vendorpay.

What is a vendor payment process?

A vendor payment process is defined as the policies that you have to pay suppliers, distributors, or contractors for the goods or services they have delivered to your business. A vendor payment process is an essential part of your business relationship.