Paying your mortgage is likely one of your largest monthly bills. To make the payment process easy, Wells Fargo offers convenient online and mobile options for mortgage customers. In this article, we’ll walk through the steps to pay your Wells Fargo mortgage online or via the mobile app.

Benefits of Paying Your Mortgage Online

Paying your mortgage through Wells Fargo’s online or mobile systems offers several advantages:

-

Convenience You can pay anytime, anywhere without having to mail in checks or visit a branch

-

Control You can view payment history set up automatic payments make one-time payments and more.

-

Security Wells Fargo uses encryption and other security measures to protect your information.

-

Time savings: Paying online is fast compared to mailing in payments. You can also set up automatic payments to save time each month.

-

Budgeting ease: The online portal and mobile app allow you to easily track payments and balance information.

How to Enroll in Online Mortgage Payments

If you have a Wells Fargo mortgage but haven’t signed up for online payments, here are the steps:

-

Have your mortgage account number ready. This was provided when you originally got the mortgage.

-

Visit wellsfargo.com and click “Sign On” in the upper right.

-

From the account dashboard, choose either “Bill Pay” or “Make a Payment” depending on what shows for your account.

-

Follow the instructions to connect your checking account you wish to use for payments.

-

Confirm your email address and provide any other requested information.

And that’s it! You should now be able to log into your account anytime to pay your mortgage online.

Paying Your Mortgage through Wells Fargo’s Website

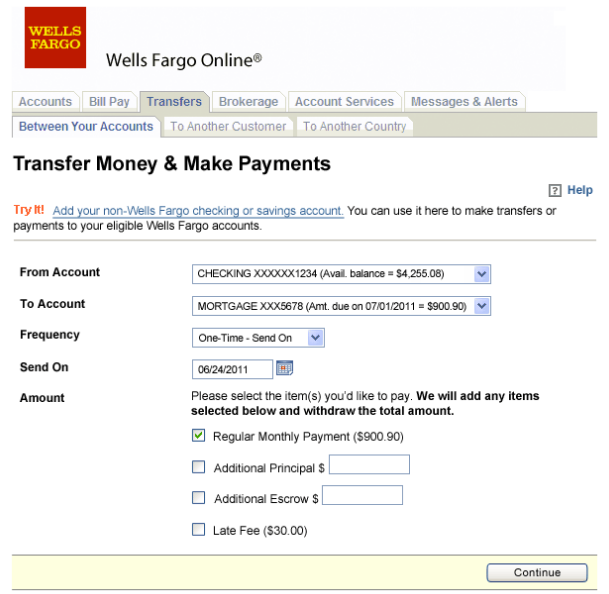

Now let’s walk through actually making a mortgage payment on Wells Fargo’s website:

-

After logging into your account at wellsfargo.com, choose the “Bill Pay” or “Make a Payment” tab.

-

Pick the mortgage account you wish to pay.

-

Enter the payment amount and date. Make sure the date allows enough time for processing if your payment is due soon.

-

Select which account the money will come from, such as checking or savings.

-

Review the payment details carefully before submitting.

-

You should receive a confirmation with reference number once the payment goes through successfully.

The site also allows you to:

-

Set up automatic recurring payments so you don’t have to log in and pay manually each month.

-

View payment history and print records for your files.

-

Update payment funding account or amount details.

-

Make one-time additional payments toward your mortgage principal.

Paying Through the Wells Fargo Mobile App

In addition to the website, Wells Fargo offers an iOS and Android mobile app with mortgage payment features. The functionality is similar to the website:

-

After installing the latest version of the Wells Fargo Mobile app, log into your account.

-

Tap the menu icon in the upper left and choose “Pay Bills”.

-

Select your mortgage account.

-

Enter the payment details.

-

Submit and view the confirmation.

You can also manage automatic payments, view history, and more from the app. The mobility makes it easy to handle your mortgage payments from anywhere.

Tips for Paying Your Mortgage with Wells Fargo

Here are some handy tips to make sure your online mortgage payments go smoothly:

-

Allow enough processing time: Online payments usually take 2-3 business days to process, while mobile payments can take 1-2 days. Factor this into when you submit.

-

Set payment reminders: Use Wells Fargo’s system to receive email or text alerts when payments are due or processed.

-

Save payment details: When setting up a recurring automatic payment, save the details so you don’t have to re-enter them each month.

-

Check statements: Review monthly statements carefully to ensure payments were accurately applied with no issues.

-

Update contact info: Keep your email, phone, and address updated so Wells Fargo can reach you if any payment problems occur.

Getting Help with Wells Fargo Online Mortgage Payments

Hopefully this guide provides all the help you need to manage paying your Wells Fargo mortgage online or from your mobile device. But if any other issues come up, here are some options:

-

Visit the online support site for FAQs, how-to guides, and chat.

-

Call customer service at 1-800-866-3862.

-

Send a secure email via your account portal.

-

Tweet @Ask_WellsFargo for help.

-

Visit a local Wells Fargo branch and speak to a banker in person.

Paying your mortgage online doesn’t have to be difficult or stressful. Wells Fargo provides the tools and support you need for simple, seamless payments. So take advantage of the convenience and start handling your monthly mortgage bill via the digital systems today.

How do I pay my Wells Fargo mortgage?

Any checking or savings account 2 and use the Transfer & Pay tab to Pay WF Accounts. By phone: Read and agree to the Terms and Conditions; and call us at 1-866-386-8519. By fax: Download and complete the enrollment form (PDF); fax it to 1-866-287-6241. We have options through Wells Fargo Online® to make paying your mortgage easier. Learn more 1.

How does Wells Fargo manage my home loan account?

Wells Fargo provides a variety of ways you can access your account information, make payments, and manage your home loan account online using your mortgage dashboard.

How do I get a Wells Fargo loan?

Enroll in Wells Fargo Online ® Call 1-800-357-6675. Call 1-866-820-9199. Find a local Wells Fargo branch near you. Find a location Financial hardship? We’re here to help if you’re having trouble making payments. See your options Feel more at home with your home loan, using your personalized mortgage dashboard.

How do I access my Wells Fargo mortgage account?

Sign on or enroll in Wells Fargo Online ®. From your Account Summary page, select your mortgage account. Select Explore Dashboard in the navigation bar at the top of the page. Use your dashboard to get a clear snapshot of your mortgage and where you stand, all in one place.