When it comes to securing a mortgage, one of the most crucial steps in the process is undergoing underwriting checks. These checks are a lender’s way of thoroughly evaluating your financial situation to determine if you qualify for the loan and, if so, under what terms and conditions. In this article, we’ll dive deep into the world of underwriting checks, exploring what they entail, why they’re necessary, and what you can do to ensure a smooth and successful experience.

What Are Underwriting Checks?

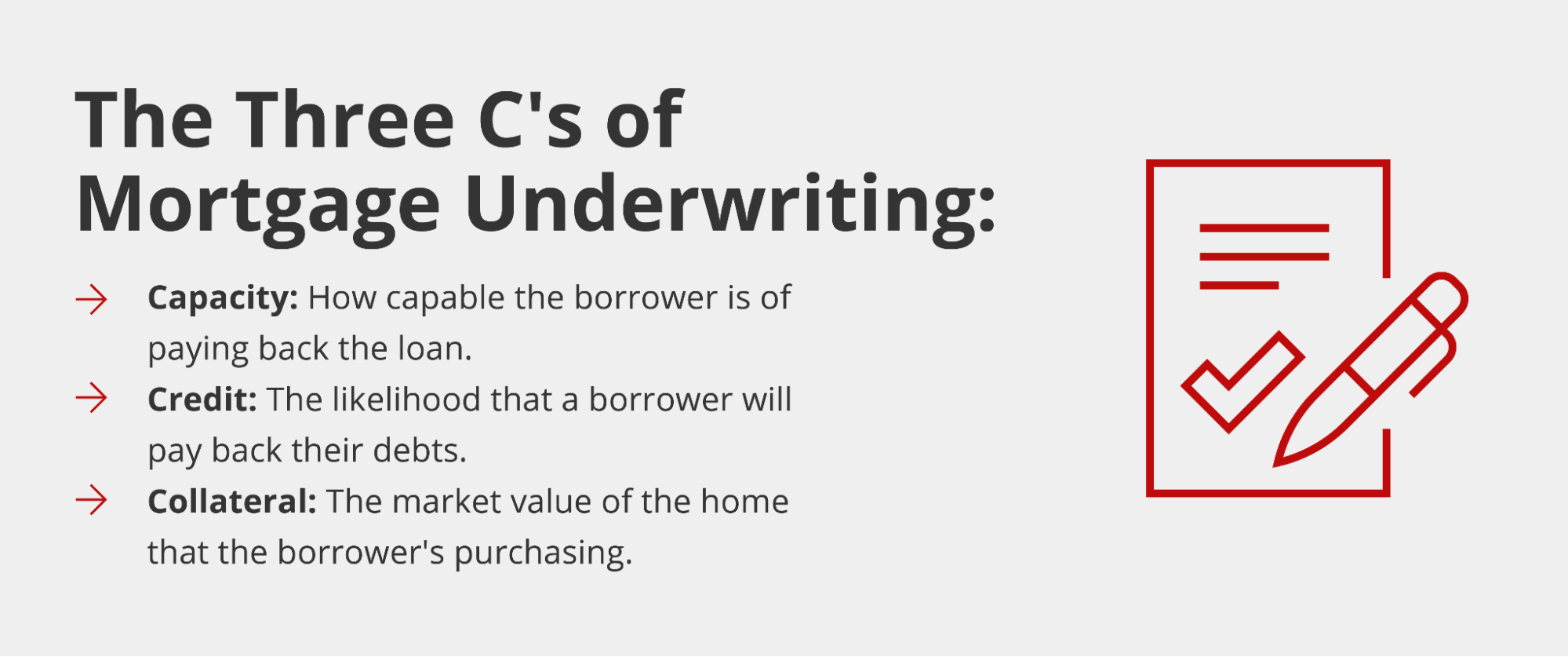

Underwriting checks, as defined by Rocket Mortgage, are the process by which “your lender verifies your income, assets, debt, credit, and property details to issue final loan approval.” An underwriter, a financial expert employed by the lender, is tasked with meticulously assessing your finances to determine your creditworthiness and ability to repay the mortgage.

During the underwriting process, the underwriter will scrutinize various aspects of your financial profile, including but not limited to:

-

Credit History: The underwriter will examine your credit report, credit score, and payment history to gauge your creditworthiness and identify any potential red flags.

-

Income and Employment: You’ll be required to provide documentation such as W-2 forms, pay stubs, and tax returns to verify your income and employment status.

-

Assets and Liabilities: The underwriter will review your assets, including savings accounts, investments, and other financial resources, as well as your existing liabilities, such as credit card debts, student loans, and other outstanding obligations.

-

Debt-to-Income Ratio (DTI): Your DTI ratio, which compares your monthly debt payments to your gross monthly income, is a crucial factor in determining your ability to handle the added financial burden of a mortgage.

-

Property Appraisal: An appraisal will be ordered to ensure that the property’s value aligns with the loan amount you’re requesting. This step helps protect both you and the lender from overvaluing the property.

Why Are Underwriting Checks Important?

Underwriting checks are essential for several reasons, including:

-

Risk Assessment: Lenders use underwriting checks to assess the risk involved in granting you a mortgage. By thoroughly evaluating your financial situation, they can determine the likelihood of you defaulting on the loan and make an informed decision about whether to approve or deny your application.

-

Compliance with Regulations: Mortgage lenders are required to follow strict guidelines and regulations set forth by government agencies and entities like Fannie Mae and Freddie Mac. Underwriting checks ensure that the lender is complying with these guidelines and not taking on excessive risk.

-

Protecting Your Interests: While underwriting checks may seem intrusive, they’re designed to protect both the lender and you, the borrower. By verifying that you can comfortably afford the mortgage payments, the lender helps prevent you from taking on more debt than you can handle.

-

Ensuring Fair Lending Practices: Underwriting checks help lenders maintain fair and consistent lending practices, ensuring that all applicants are evaluated based on the same criteria and that discrimination does not occur.

Tips for Smooth Underwriting Checks

While underwriting checks are a necessary part of the mortgage process, there are steps you can take to help ensure a smoother and more efficient experience:

-

Be Prepared: Gather all the required documents in advance, such as tax returns, pay stubs, bank statements, and any other relevant financial information. This will help the underwriter quickly and accurately assess your situation.

-

Maintain Good Credit: Your credit score and credit history play a significant role in the underwriting process. Make sure to monitor your credit report, address any potential issues, and avoid taking on new debts or opening new credit lines during the application process.

-

Explain Irregularities: If there are any irregularities or unusual circumstances in your financial situation, be proactive and provide explanations to the underwriter. This could include job changes, gaps in employment, large deposits or withdrawals, or any other factors that may raise questions.

-

Respond Promptly: During the underwriting process, the lender may request additional information or documentation. Respond promptly to these requests to avoid delays and ensure a smooth progression through the process.

-

Consider Working with a Mortgage Professional: A knowledgeable mortgage professional can guide you through the underwriting process, help you understand the requirements, and assist in preparing the necessary documentation.

The Bottom Line

Underwriting checks are a critical component of the mortgage application process, designed to protect both the lender and the borrower. By verifying your income, assets, debts, credit, and property details, underwriters can assess your ability to repay the loan and determine the appropriate terms and conditions.

While the process may seem daunting, being prepared, maintaining good credit, and working closely with your lender or mortgage professional can help make the experience smoother and increase your chances of a successful outcome. Ultimately, underwriting checks are in place to ensure a responsible and sustainable mortgage lending practice for all parties involved.

Mortgage Explainer: What is Underwriting?

FAQ

What does an underwriter check?

How long does it take for the underwriter to make a decision?

How likely is it to get denied during underwriting?

What happens when underwriting is done?