Paying your phone and internet bill on time every month is crucial for avoiding service interruptions and additional fees from Verizon But life happens, and you may find yourself unable to pay your Verizon bill occasionally. If you don’t pay your Verizon bill, what exactly happens?

In this comprehensive guide, we’ll break down the potential consequences, fees, and impacts to your credit if you miss paying your Verizon bill. We’ll also provide helpful tips on how to avoid service interruptions and arrange alternate payment plans when you can’t pay the full amount due.

Overview of Verizon Bill Payment Process

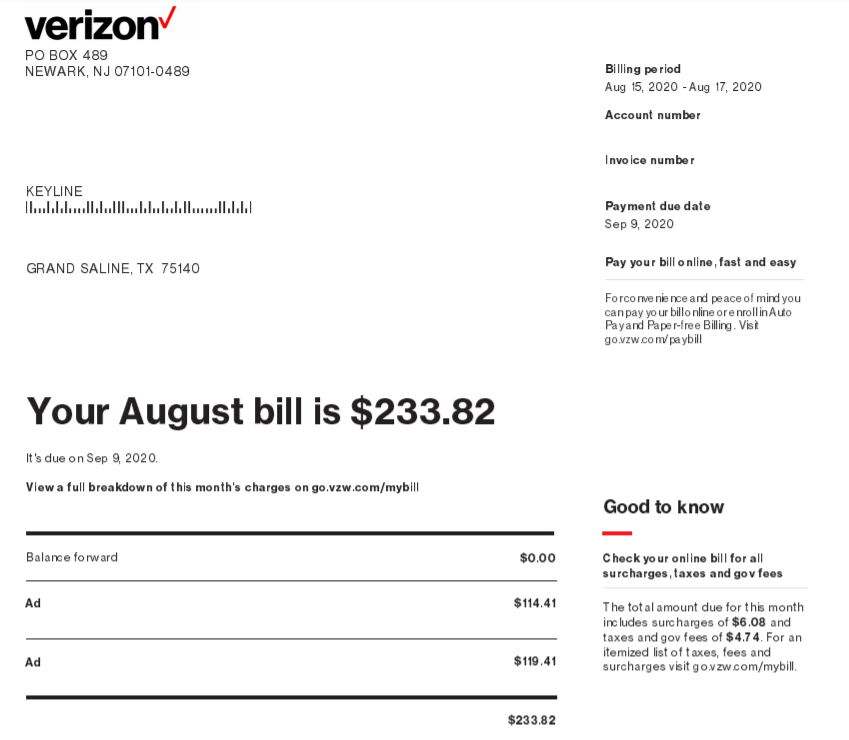

- Verizon bills for mobile, internet, and TV services on a monthly cycle

- Payment is due by the due date shown on your bill, typically within 30 days

- You can pay online, by phone, by mail, or at authorized payment locations

- If payment is not received by the due date, late fees apply

What Happens If You Miss the Due Date

Missing one payment by the due date can start a cascade of late fees, service interruptions, and credit impacts. Here is an overview of the common consequences:

Late Payment Fees

- Verizon charges a late fee if payment is not received by the due date

- The late fee is typically $5 or 5% of the unpaid balance, whichever is greater

- Late fees show up on the next month’s bill

- For example, if your bill is $100 and you don’t pay on time, you may see a $5 late fee on your next bill

Service Interruption

- If your bill remains unpaid after the due date, Verizon may suspend your service temporarily

- This involves loss of mobile service, internet, and TV access until the past due amount is paid

- A $20 per line reactivation fee may apply if service was suspended

Collections & Credit Impacts

- If you go an extended period without paying, Verizon may send the account to collections

- This can show up on your credit report and negatively impact your credit score

- Making payment arrangements can help avoid collections process

Permanent Disconnection

- For accounts severely past due, Verizon may permanently disconnect service

- Reactivating service may require paying the full past due balance

- Disconnection can also impact your credit history and ability to open other accounts

How Long Before Service is Suspended for Non-payment?

Verizon doesn’t publicly provide an exact timeframe for when service suspension occurs for non-payment. However, you can expect consequences to escalate in this general timeline:

- 1 week late: Late fee applies

- 2-3 weeks late: Increased late fees, collections notices, service suspension warning

- 1 month late: Temporary service suspension possible

- 2+ months late: High risk of service suspension and collections

Actual timeframes depend on factors like your payment history and amount owed. But in general service interruption is likely within 1 month of missing a payment.

Arrange Payment Plans to Avoid Interruption

If you won’t be able to pay your full Verizon bill on time you have options to avoid suspension or collections.

Verizon allows customers to set up payment arrangements or “promise-to-pay” plans when you need more time to pay your balance. This involves agreeing to pay the overdue amount by a later date than your original bill due date.

Some key points about Verizon payment arrangements:

- You can set up payment plans online, by phone, or app

- Lets Verizon know you need more time but intend to pay

- Can avoid service suspension and collections if paid as agreed

- Late payment fees may still apply

- Allows you to pay a portion immediately and the remainder later

Payment plans buy you time and keep services active. But you must follow through and pay the agreed amount by the new due date. If you miss the new due date, your services could still be interrupted.

How to Set Up a Verizon Payment Arrangement

Setting up a payment plan through Verizon is easy and can be done entirely online. Just follow these steps:

- Log in to your My Verizon account online or in the mobile app

- Go to the Payment Arrangements section

- Select “Make Payment Arrangement”

- Choose from available extension dates and payment options

- Agree to pay the past due amount by the new date

- Verify the arrangement details and submit

That’s it! Verizon will send you confirmation of the new payment plan by email and text. As long as you pay the agreed amount by the new due date, your services will stay active.

You can also call Verizon or speak to an online representative to set up arrangements. But keep in mind there is a $10 agent assistance fee when setting up payment plans through customer service.

What If You Still Can’t Pay After an Extension?

Ideally you’ll be able to pay the full past due amount by the new payment arrangement due date. But if your financial hardship continues, you still have options to avoid suspension:

- Ask for a further extension – Based on your account history, you may be able to extend your due date again or set up a new plan

- Pay partial amount – Paying even a portion of what you owe can delay suspension in some cases

- Request temporary suspended status – You can request to temporarily suspend your own service to avoid collections impacts

Communication is key if you need to adjust payment plans. Keep Verizon informed about your situation to prevent unexpected service interruptions.

Steps to Restore Service After Suspension

If your service is unfortunately suspended by Verizon for non-payment, take the following steps to get restored:

- Pay the full past due balance immediately

- Verizon will automatically reopen service once payment is received and processed, typically in 1-2 business days

- A $20 per line reactivation fee will be charged

- You may need to reset equipment like routers after service is restored

Restoring service requires clearing the full past due amount. Partial payments won’t prompt reactivation after suspension occurs. Avoid service interruptions in the first place by setting up a payment plan if you anticipate payment issues.

Ways to Avoid Late Verizon Bills

While payment plans can provide short term relief, it’s best to avoid past due situations completely. Here are some tips to stay on top of payments:

- Set up autopay – Have Verizon automatically deduct your bill from a bank account or credit card each month

- Use bill reminders – Verizon can text or email reminders ahead of your due date

- Pay online – Paying through your My Verizon account means never missing a mail deadline

- Review billing changes – Check statements routinely for rate hikes or new charges so payments stay current

Staying proactive is the best way to prevent the headaches of late payments and service suspensions down the road.

Impact to Your Credit if Sent to Collections

As a last resort, severely past due Verizon accounts may be sent to debt collectors. This can negatively impact your credit report and score.

Here’s how Verizon collections can affect your credit:

- The unpaid bill balance is reported as a collections account with credit bureaus

- This shows up on your credit report for 7 years

- Your credit score can drop by over 100 points

- Other lenders may decline applications due to the negative item

- Loan terms may become less favorable due to the credit damage

Avoiding collections is critical to maintaining good credit health. Payment plans can help prevent your account being sent for collections. If an account does go to collections, you may be able to negotiate pay-for-delete arrangements with the collector to minimize credit impacts after paying the balance.

Key Takeaways on Missed Verizon Payments

- Late fees apply after the bill due date passes

- Service can be suspended within 1 month of non-payment

- Permanent disconnection is possible for severely delinquent accounts

- Payment arrangements allow more time to pay and avoid interruptions

- Restoring service requires paying the full past due balance

- Collections can harm your credit if unpaid long term

Don’t let a short term financial issue turn into a long-term credit nightmare. Stay in communication with Verizon, set up payment plans as needed, and prioritize clearing past due balances. With proactive planning, you can get through temporary cash shortages without losing your vital internet and mobile access.

Frequently Asked Questions

How much is the Verizon late fee?

Verizon charges a variable late fee of $5 or 5% of the unpaid balance, whichever is greater. So for a $100 bill, the late fee would be $5. The late fee increases the longer the bill remains unpaid.

Can I avoid late fees with a payment plan?

Unfortunately no, late payment fees from Verizon typically still apply when you set up a payment arrangement past the original due date. Payment plans prevent service interruption but not late fees.

What if I can only afford to pay $50 toward my $100 Verizon bill now?

Paying a portion

How do I set up a payment arrangement online?

You can self-serve and schedule a payment or set up a promise to pay for free on the Payment arrangements page in My Verizon. Follow the prompts to set up the arrangement. Alternatively you can work with a Customer Service Representative or a Live Chat Representative, who can set up the payment arrangement for you, for a fee of $10. Note: You can set up an arrangement only if your current bill isnt paid and an amount is due. If your bill is paid, you wont see payment arrangement options.

What’s a payment arrangement?

When you need more time to pay your Verizon mobile bill, you can make an agreement to pay us on a date thats after your bills due date. Setting up a payment arrangement:

- Lets us know you plan to take care of your bill

- Can keep your Verizon mobile service from being interrupted

- Can keep collection activity on your account from starting