Medicare supplement plans, also known as Medigap plans, are private insurance policies designed to cover the gaps in Original Medicare coverage. With a wide range of options available, finding the most affordable plan can be a daunting task. In this comprehensive article, we’ll guide you through the process of identifying the cheapest Medicare supplement plan that meets your needs.

Understanding Medicare Supplement Plans

Before we dive into the cost aspect, let’s clarify what Medicare supplement plans are and how they work. These plans are standardized by the federal government and offered by private insurance companies. They help cover out-of-pocket expenses such as deductibles, copayments, and coinsurance that Original Medicare doesn’t cover.

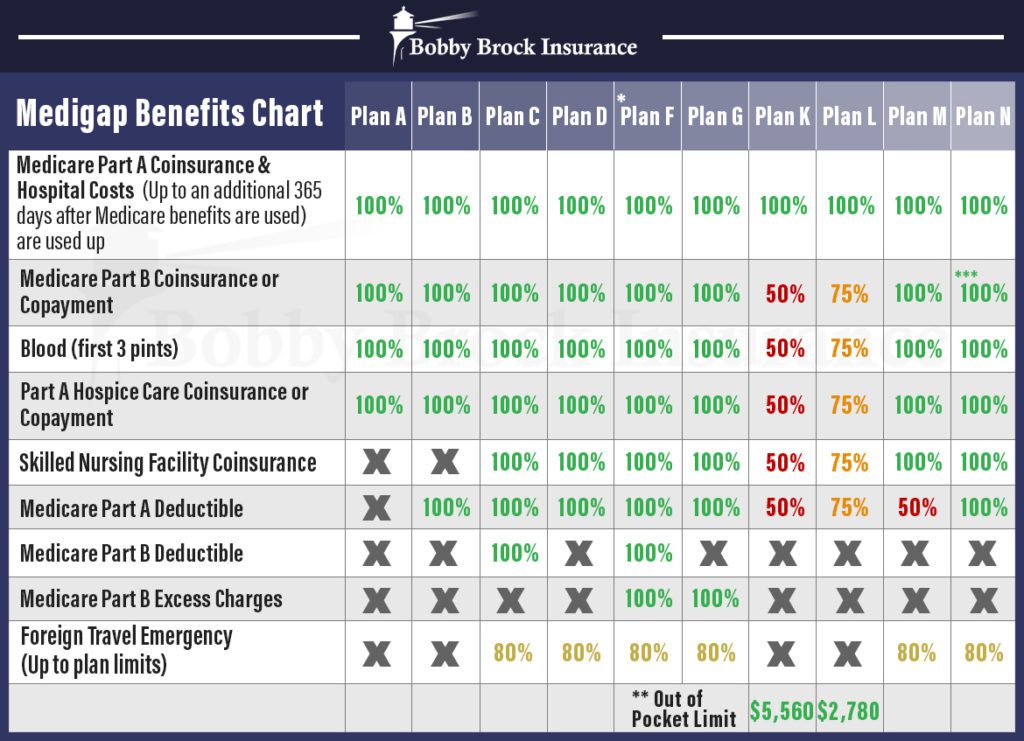

There are currently 10 standardized Medigap plans available, each labeled with a letter (A, B, C, D, F, G, K, L, M, and N). The plans vary in terms of the benefits they provide and the associated premiums. It’s essential to understand that the benefits for each plan are the same across all insurance companies, but the premiums can vary significantly.

The Cheapest Medicare Supplement Plan: Plan K

According to recent reports and official Medicare sources, Plan K is considered the least expensive Medicare supplement plan. In 2024, the average cost of Plan K is estimated to be around $77 per month.

Plan K offers partial coverage for some of the out-of-pocket expenses not covered by Original Medicare. Here are the key benefits:

- It covers 50% of the Part A deductible

- It covers 50% of the Part B coinsurance or copayment

- It covers 50% of the Part A hospice care coinsurance or copayment

- It covers 50% of the skilled nursing facility care coinsurance

- It has an annual out-of-pocket limit of $6,940 in 2024

While Plan K provides less comprehensive coverage than some of the other Medigap plans, it can be an attractive option for individuals on a tight budget who are willing to share a portion of the costs.

Factors Affecting the Cost of Medicare Supplement Plans

It’s important to note that the cost of Medicare supplement plans can vary based on several factors:

- Location: Premiums can differ significantly depending on the state and even the county or zip code where you live.

- Age: Some insurance companies charge higher premiums for older enrollees due to the increased risk associated with advanced age.

- Tobacco use: Individuals who use tobacco products may face higher premiums.

- Gender: In some states, insurance companies are allowed to charge different premiums based on gender.

- Discounts: Many insurers offer discounts for certain groups, such as members of organizations or those who pay their premiums annually.

To find the most affordable plan, it’s crucial to compare rates from multiple insurance companies and consider all the factors that may impact the cost.

Tips for Finding the Cheapest Medicare Supplement Plan

Here are some practical tips to help you find the most affordable Medicare supplement plan:

- Shop around: Don’t settle for the first plan you come across. Compare rates from various insurance companies to find the best deal.

- Consider your health status: If you’re in good health and willing to share some of the costs, a plan like Plan K or Plan L could be a cost-effective option.

- Evaluate your budget: Determine how much you can reasonably afford to pay in premiums, and prioritize plans that fit within your budget.

- Explore discounts: Look for any available discounts or group rates that you may be eligible for.

- Review annually: Medicare supplement plan premiums can change yearly, so it’s essential to review your options annually and switch to a more affordable plan if necessary.

Final Thoughts

Finding the cheapest Medicare supplement plan requires careful research and consideration of your specific needs and circumstances. While Plan K is currently the most affordable option on average, it may not be the best choice for everyone. Remember to evaluate the coverage levels, out-of-pocket costs, and your personal health situation before making a decision.

By following the tips outlined in this article and staying informed about the latest changes in Medicare supplement plans, you can navigate the process confidently and secure the most cost-effective coverage for your healthcare needs.

What State is the Cheapest for Medicare?

FAQ

What does an average person pay for Medicare with a supplement?

|

State

|

Monthly Cost

|

Rank from least expensive (1) to most expensive (51)

|

|

California

|

$162.93

|

45

|

|

Colorado

|

$127.76

|

29

|

|

Connecticut

|

$227.06

|

49

|

|

Delaware

|

$150.99

|

42

|

What is the most popular supplement plan for Medicare?

How much does Plan G cost a month?

Is there a Medicare Supplement that covers everything?