When it comes to life insurance, understanding the intricate details can be a daunting task. One crucial aspect that often raises questions is the face amount, particularly in the case of a graded death benefit life insurance policy. In this article, we’ll dive deep into the nitty-gritty of what the face amount entails for a $50,000 graded death benefit life insurance policy.

What is a Graded Death Benefit Life Insurance Policy?

Before we delve into the face amount, it’s essential to understand the concept of a graded death benefit life insurance policy. This type of policy is designed for individuals who may have difficulty securing traditional life insurance coverage due to pre-existing health conditions or other risk factors.

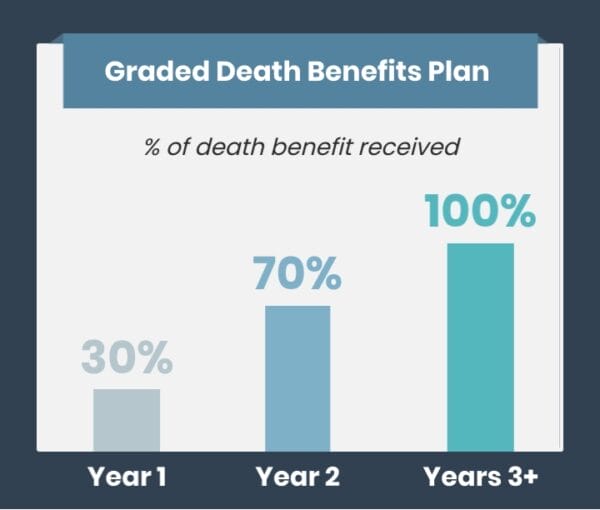

Unlike traditional policies, where the full death benefit is available from day one, a graded death benefit policy offers a gradual increase in the payout over a specified period, typically two to three years. During this graded period, if the policyholder were to pass away, the beneficiary would receive a portion of the total death benefit, with the full amount becoming available after the graded period has elapsed.

Understanding the Face Amount

The face amount, also known as the death benefit or face value, is the sum of money that the life insurance company agrees to pay to the designated beneficiary upon the policyholder’s death. In the case of a $50,000 graded death benefit life insurance policy, the face amount at the time of issuance is not the full $50,000.

Instead, the face amount starts at a lower value and gradually increases over the graded period, typically spanning two to three years. Here’s how it typically works:

- Year 1: If the policyholder were to pass away during the first year, the beneficiary would receive a portion of the face amount, often ranging from 30% to 40% of the total $50,000.

- Year 2: In the second year, the face amount increases, and the beneficiary would receive a higher percentage, usually around 70% of the $50,000.

- Year 3 and beyond: After the graded period is over, the full face amount of $50,000 becomes available to the beneficiary in the event of the policyholder’s death.

It’s important to note that the specific percentages and graded period may vary depending on the insurance provider and the policy terms.

Why the Gradual Increase?

The gradual increase in the face amount during the graded period is a risk management strategy employed by insurance companies. By limiting the initial payout, insurers aim to mitigate the potential financial impact of insuring individuals with elevated risk factors.

This approach allows insurance companies to provide coverage to individuals who might otherwise be denied traditional life insurance policies while still protecting themselves from potential losses in the early years of the policy.

Considerations and Importance of Understanding the Face Amount

When considering a graded death benefit life insurance policy, it’s crucial to thoroughly understand the face amount and how it evolves over time. Here are a few key points to keep in mind:

- Review the policy details carefully to understand the specific percentages and timeline for the face amount increase.

- Ensure that the initial face amount and its gradual increase align with your financial needs and expectations.

- Consider whether the graded period is acceptable based on your current health condition and future prospects.

- Discuss any concerns or questions with your insurance agent or provider to make an informed decision.

By comprehending the face amount and its implications, you can make an educated choice about whether a graded death benefit life insurance policy is the right fit for your unique circumstances.

Remember, the face amount is a critical component of any life insurance policy, as it determines the financial protection and legacy you leave behind for your loved ones. Take the time to understand it fully and seek professional guidance if needed.

How Long Does It Take to Receive a Life Insurance Death Benefit

FAQ

How to calculate the face amount of a life insurance policy?

What is the face value of the death benefit of a life insurance policy?

Who is the face amount of a life insurance policy paid when the insured dies?

What happens in a group life policy with the death benefit of more than 50000?