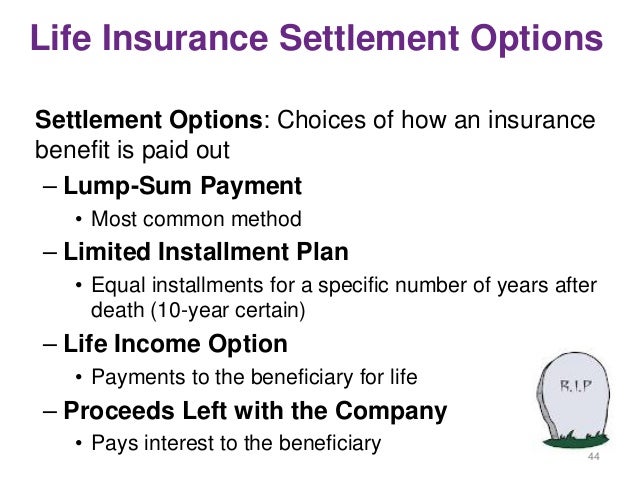

When a loved one passes away, the last thing on your mind is dealing with financial matters. However, if you are the beneficiary of a life insurance policy, understanding the payout options can help you make an informed decision about how to receive the death benefit. This article will explore the different ways life insurance payouts are distributed, so you can be prepared when the time comes.

The Lump Sum Payout

The most common method of receiving a life insurance payout is in the form of a lump sum. As the name suggests, this option provides you with the entire death benefit amount in a single, tax-free payment. According to Forbes Advisor, the average life insurance face amount for an individual policy is $168,000, but policies can range from small burial insurance plans to multimillion-dollar payouts.

Pros of a Lump Sum Payout

- Flexibility: With a lump sum payout, you have complete control over how to use the funds. You can pay off debts, cover living expenses, save for the future, or invest the money as you see fit.

- Immediate Access: You receive the entire death benefit immediately, allowing you to address any pressing financial needs without delay.

- No Restrictions: Unlike other payout options, there are no limitations or conditions on how you can use the money from a lump sum payout.

Cons of a Lump Sum Payout

- Responsibility: Managing a large sum of money can be overwhelming, and there is a risk of mismanaging or overspending the funds if you don’t have a solid financial plan.

- Taxable Interest: If you choose to invest or deposit the lump sum into an interest-bearing account, you’ll need to pay taxes on the interest earned.

- FDIC Limits: If the death benefit is substantial, you may need to spread the funds across multiple FDIC-insured accounts to ensure full protection, as the FDIC currently insures deposits up to $250,000 per depositor, per bank.

Life Insurance Annuity

Another option for receiving your life insurance payout is through an annuity. With this method, the insurance company converts the death benefit into a series of periodic payments, providing you with a guaranteed stream of income for life or a specified period.

Pros of a Life Insurance Annuity

- Guaranteed Income: An annuity offers a reliable income stream, which can be especially beneficial for retirees or those without other sources of steady income.

- Longevity Protection: If you choose a lifetime annuity, you will continue receiving payments for as long as you live, regardless of how long that may be.

- Tax Deferral: The portion of each annuity payment that represents a return of your principal is generally not taxable, allowing for potential tax deferral benefits.

Cons of a Life Insurance Annuity

- Inflexibility: Once you set up an annuity, it can be difficult or costly to change the terms or access the remaining principal.

- Limited Liquidity: Annuities typically provide limited access to the full lump sum amount, which can be problematic if you need a large sum of money for an unexpected expense.

- Fees and Charges: Some annuities may come with additional fees, such as surrender charges or administrative costs, which can reduce your overall payout.

Retained Asset Account

A third option offered by some insurers is a retained asset account. With this approach, the insurance company holds onto the death benefit and provides you with a checkbook or draft account to access the funds as needed.

Pros of a Retained Asset Account

- Convenience: You can access the funds gradually without committing to a structured payout schedule or annuity.

- FDIC Protection: Retained asset accounts are typically protected by state guaranty associations, providing similar coverage to FDIC insurance for bank deposits.

- Interest Earning: The account may earn interest, allowing your funds to grow over time.

Cons of a Retained Asset Account

- Limited Interest: The interest rate offered by the insurance company may be lower than what you could earn through other investment vehicles.

- Taxable Interest: Any interest earned on the retained asset account is generally taxable as ordinary income.

- Accessibility Concerns: While convenient, some beneficiaries may prefer to have the funds in their own accounts for easier access and management.

Choosing the Right Payout Option

The best life insurance payout option for you will depend on your unique financial situation, goals, and preferences. Here are some factors to consider:

- Age and Life Stage: Younger beneficiaries may prefer the flexibility of a lump sum, while retirees or those nearing retirement may appreciate the guaranteed income of an annuity.

- Financial Literacy: If you’re comfortable managing large sums of money, a lump sum may be suitable. If not, an annuity or retained asset account could provide more structure.

- Other Income Sources: If you have other sources of steady income, a lump sum may be more appealing. If not, an annuity could provide valuable supplemental income.

- Tax Considerations: Evaluate the potential tax implications of each payout option, as well as your overall tax situation.

- Immediate Needs: If you have pressing expenses or debts to pay off, a lump sum may be preferable for immediate access to the full death benefit.

It’s always a good idea to consult with a financial advisor or tax professional to help you weigh the pros and cons of each life insurance payout option and make the best decision for your circumstances.

Conclusion

When you’re dealing with the loss of a loved one, understanding your life insurance payout options can help alleviate some of the financial stress. Whether you choose a lump sum, annuity, or retained asset account, make sure to carefully consider your needs, goals, and overall financial situation. By being prepared and informed, you can ensure that the life insurance death benefit serves its intended purpose of providing financial security during a difficult time.

What To Do With A Lump Sum Insurance Payout

FAQ

Does life insurance pay a lump sum?

How long do you have to pay life insurance before it pays out?

Can you cash out life insurance before death?

Do life insurance companies actually pay out?