As we age, the cost of prescription drugs can become a significant burden on our finances. That’s where Medicare Part D comes in, providing much-needed relief by offering prescription drug coverage to Medicare beneficiaries. However, with numerous plans available, finding the most affordable option can be a daunting task. In this article, we’ll explore the cheapest Medicare Part D drug plans, helping you make an informed decision and potentially save a considerable amount of money.

Understanding Medicare Part D Plans

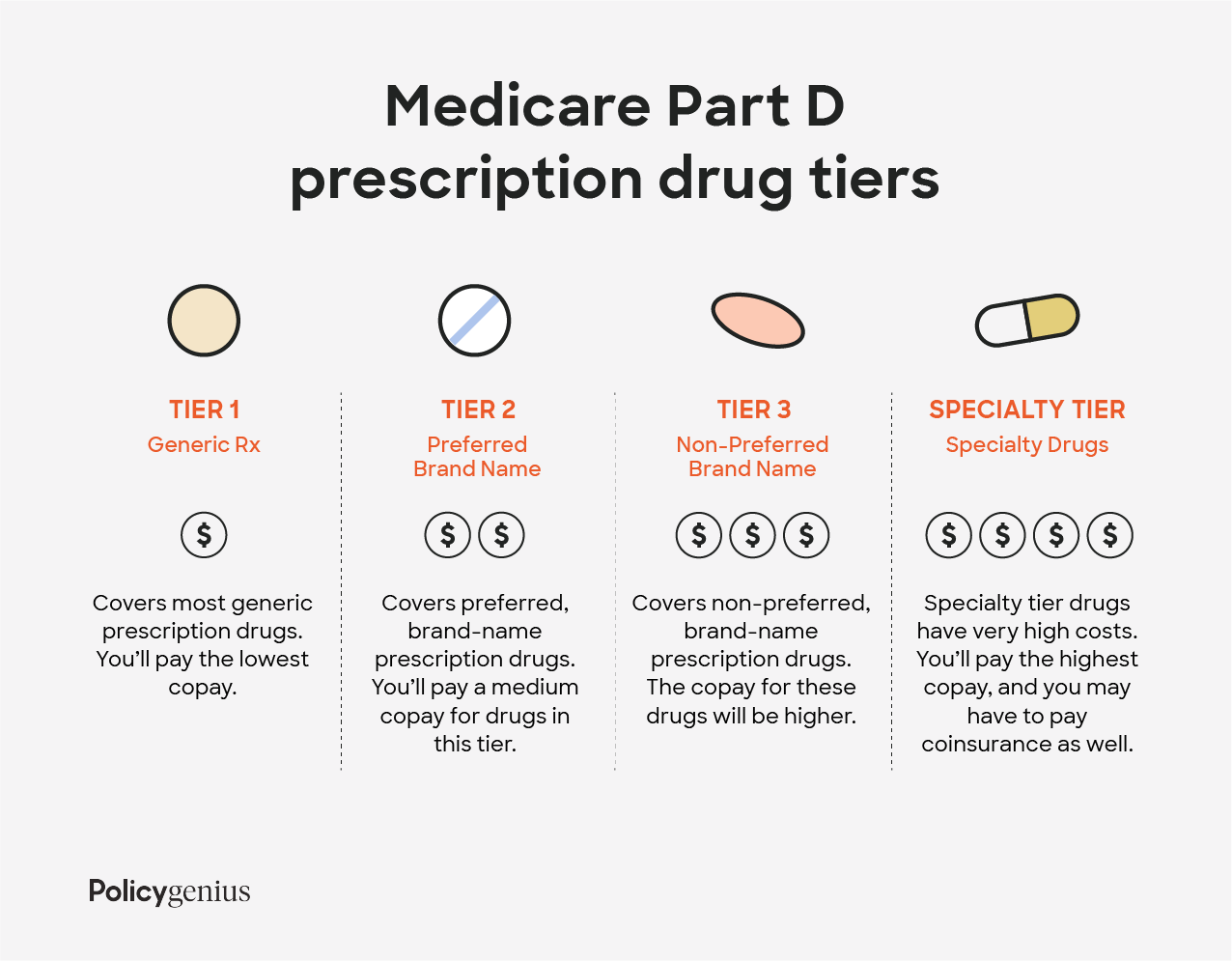

Before diving into the cheapest options, let’s briefly review Medicare Part D plans. These plans are offered by private insurance companies and are designed to help cover the costs of prescription medications for Medicare beneficiaries. Each plan has its own formulary (list of covered drugs), premiums, deductibles, and copayments or coinsurance rates.

It’s important to note that while the monthly premium is a significant factor in determining the overall cost of a plan, it’s not the only consideration. You should also evaluate the plan’s deductible, copayments or coinsurance rates, and the specific drugs covered to ensure you’re getting the best value for your needs.

The Cheapest Medicare Part D Plan: SilverScript SmartRx

According to the information provided, the SilverScript SmartRx plan from Aetna, a CVS Health company, offers the lowest average monthly premium for a Medicare Part D drug plan. With an average monthly cost of $5.92, this plan is an attractive option for those looking to keep their prescription drug coverage expenses to a minimum.

However, it’s important to note that the SilverScript SmartRx plan comes with a standard annual deductible of $505 for most tiers, except for Tier 1 preferred generics and select insulins at preferred pharmacies. This means that you’ll need to pay the full cost of your medications (excluding Tier 1 preferred generics and select insulins) until you reach the $505 deductible.

Despite the low monthly premium, the SilverScript SmartRx plan has a respectable 3.5-star rating from the Centers for Medicare and Medicaid Services (CMS), indicating a decent level of customer satisfaction and plan performance.

Other Low-Cost Medicare Part D Plans

While the SilverScript SmartRx plan offers the lowest average monthly premium, there are a few other low-cost Medicare Part D plans worth considering:

-

WellCare Value Script: This 3.5-star plan has an average monthly cost of around $12, with $0 copays for Tier 1 and Tier 2 generic medications at preferred pharmacies. However, there is a $505 annual deductible for Tiers 3, 4, and 5 medications.

-

Humana Walmart Value Rx Plan: With a 4-star rating and an average weighted monthly premium of $22.70, this plan offers generic medications at copays ranging from $1 to $4. Like many other plans, there is a $505 annual deductible for Tiers 3, 4, and 5.

-

WellCare Classic: Another 3.5-star option, the WellCare Classic PDP has an average monthly cost of around $31.80. Generic medications typically cost between $0 and $10, and there is a $505 annual deductible.

It’s important to remember that while these plans may have lower monthly premiums, the overall cost will depend on the specific medications you take and the associated copays or coinsurance rates. Additionally, some plans may offer additional benefits or coverage during the Medicare Part D coverage gap (also known as the “donut hole”), which can impact your overall expenses.

Factors to Consider When Choosing a Medicare Part D Plan

While the monthly premium is an essential factor in selecting a Medicare Part D plan, it shouldn’t be the only consideration. Here are some other factors to keep in mind:

-

Deductible: As mentioned earlier, most Medicare Part D plans have an annual deductible, which can range from $0 to $505 in 2024. A higher deductible can result in higher out-of-pocket costs initially, but it may be offset by a lower monthly premium.

-

Copays and coinsurance rates: Evaluate the copays and coinsurance rates for the medications you currently take or anticipate needing. These can vary significantly between plans and can impact your overall costs.

-

Drug formulary: Make sure the plan covers the specific medications you need. Some plans may have a more comprehensive formulary, while others may exclude certain drugs or require prior authorization.

-

Pharmacy network: Check if your preferred pharmacy is included in the plan’s network. Using an in-network pharmacy can result in lower costs.

-

Additional benefits: Some plans may offer additional benefits, such as coverage for certain vaccines or reduced costs for mail-order prescriptions.

Working with a Licensed Insurance Agent

Navigating the complexities of Medicare Part D plans can be overwhelming, especially when trying to balance costs and coverage. Working with a licensed insurance agent can be invaluable in this process. These professionals have in-depth knowledge of the various plans available and can help you evaluate your options based on your specific needs and budget.

An insurance agent can provide personalized recommendations, taking into account your current medications, preferred pharmacies, and any anticipated changes in your health condition. They can also guide you through the enrollment process and assist with any questions or concerns you may have.

Conclusion

Finding the cheapest Medicare Part D drug plan is an important step in managing your healthcare expenses during retirement. While the SilverScript SmartRx plan from Aetna offers the lowest average monthly premium, it’s crucial to evaluate other factors such as deductibles, copays, and drug coverage to ensure you’re getting the best value for your needs.

By considering all aspects of a Medicare Part D plan and seeking guidance from a licensed insurance agent, you can make an informed decision and potentially save a significant amount of money on your prescription drug costs.

How to Find a Medicare Drug Plan – DIY – Medicare Part D

FAQ

Is SilverScript a good Part D plan?

Who has the best prescription plan for seniors?

|

Product

|

Forbes Health Ratings

|

Learn More

|

|

UnitedHealthcare

|

5.0

|

Get A Quote On Medicare Enrollment’s Website

|

|

Cigna

|

4.8

|

Get A Quote On Medicare Enrollment’s Website

|

|

Humana

|

4.6

|

Get A Quote On Medicare Enrollment’s Website

|

|

Aetna

|

4.4

|

Get A Quote On Medicare Enrollment’s Website

|

Do all Medicare Part D plans cost the same?

How much will SilverScript cost in 2024?