Are you curious about how Medicare, the federal health insurance program for older adults and certain individuals with disabilities, is funded? If so, you’ve come to the right place. In this comprehensive article, we’ll dive deep into the world of Medicare funding, exploring its sources and breaking down the intricate details in an easy-to-understand manner.

The Backbone of Medicare Funding: Payroll Taxes

The primary source of funding for Medicare is the Federal Insurance Contributions Act (FICA) payroll taxes. These taxes are paid by both employees and employers, with each contributing a specific percentage of an individual’s earnings.

According to the information provided, employees pay 1.45% of their earnings into FICA, which goes toward funding Medicare. Employers also contribute an additional 1.45%, bringing the total contribution to 2.9% of an employee’s earnings.

It’s important to note that while the portion of FICA taxes that cover Social Security payments is levied only on earnings up to a specific annual limit (currently $147,000 for 2022), the Medicare tax is applied to every penny you earn, regardless of your income level.

The Medicare Trust Funds: Where the Money Resides

The money collected through FICA payroll taxes is deposited into two separate trust funds managed by the U.S. Treasury:

-

Hospital Insurance (HI) Trust Fund

- Funded by payroll taxes, income taxes on Social Security benefits, and Medicare Part A premiums

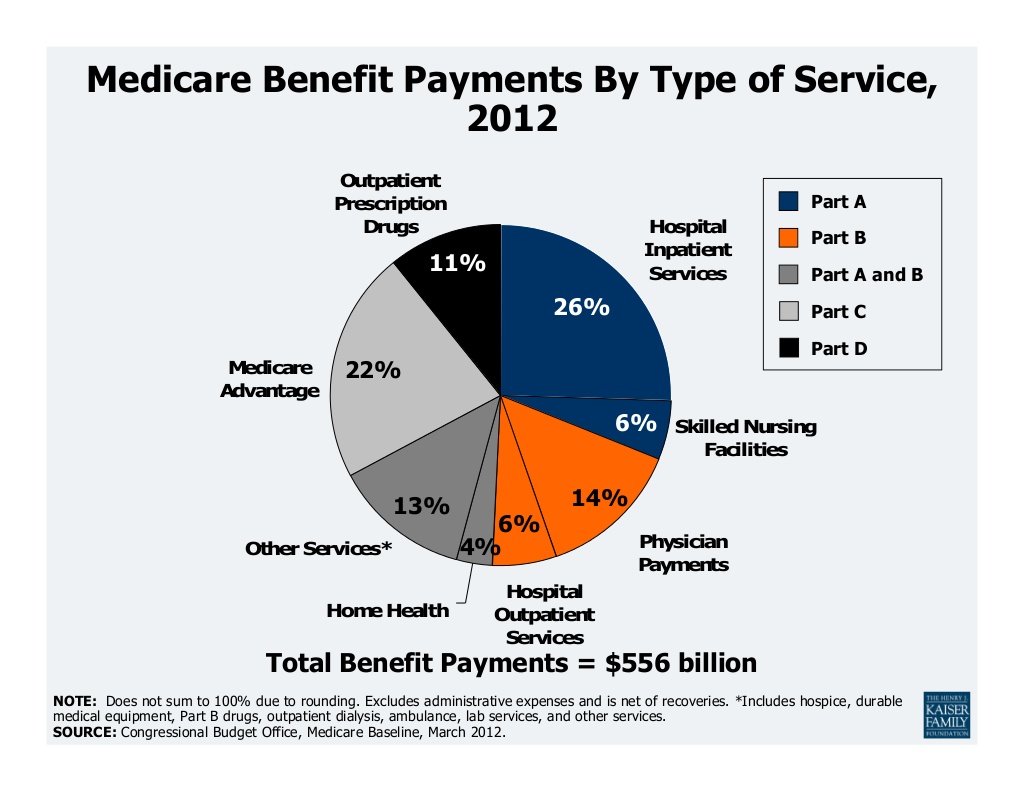

- Covers expenses related to Medicare Part A, including inpatient hospital care, skilled nursing facility care, home health care, and hospice care

- Also covers administrative costs associated with the Medicare program

-

Supplementary Medical Insurance (SMI) Trust Fund

- Funded by funds authorized by Congress, premiums from Medicare Part B and Part D enrollees, and interest earned on investments

- Covers expenses related to Medicare Part B (outpatient services) and Part D (prescription drug coverage)

- Also covers administrative costs associated with these parts of the Medicare program

These trust funds are dedicated solely to the Medicare program and cannot be used for any other purposes.

Additional Sources of Medicare Funding

While payroll taxes constitute the primary source of funding for Medicare, there are several other sources that contribute to the program’s financial stability:

- Interest earned on trust fund investments: The Medicare trust funds are invested in special-issue government securities, which earn interest that is added to the funds.

- Income taxes paid on Social Security benefits: A portion of the income taxes paid by individuals with higher incomes who receive Social Security benefits is allocated to the Hospital Insurance (HI) Trust Fund.

- Premiums from Medicare beneficiaries: Individuals enrolled in Medicare Part A (if not eligible for premium-free coverage), Part B, and Part D pay monthly premiums that contribute to the program’s funding.

The Self-Employed and Medicare Funding

For self-employed individuals, the responsibility of contributing to Medicare’s funding falls entirely on their shoulders. They must pay the full 2.9% FICA tax rate, as there is no employer to split the contribution.

Conclusion

Medicare’s funding is a complex and intricate system that relies primarily on payroll taxes contributed by employees and employers. The program’s financial stability is further bolstered by various other sources, including interest earned on investments, income taxes on Social Security benefits, and premiums paid by beneficiaries.

Understanding the sources of Medicare funding is crucial for ensuring the program’s longevity and ability to provide quality healthcare services to millions of Americans. By contributing to the system through payroll taxes and other means, we can help secure a reliable and sustainable healthcare safety net for ourselves and future generations.

The Price Of Medicare – How Much Will You Pay?

FAQ

Who pays for Medicare in the US?

Where does Medicare money come from?

Does everyone pay Medicare?

How is Medicare for All funded?