When it comes to retirement planning, annuities often spark curiosity and confusion in equal measure. Some view them as a safe haven for their hard-earned savings, while others perceive them as complex financial instruments. However, once you delve into the intricate details, the reasons for purchasing an annuity become remarkably clear. In this comprehensive guide, we’ll unravel the allure of annuities and shed light on why they could be a valuable addition to your retirement portfolio.

The Promise of Guaranteed Income for Life

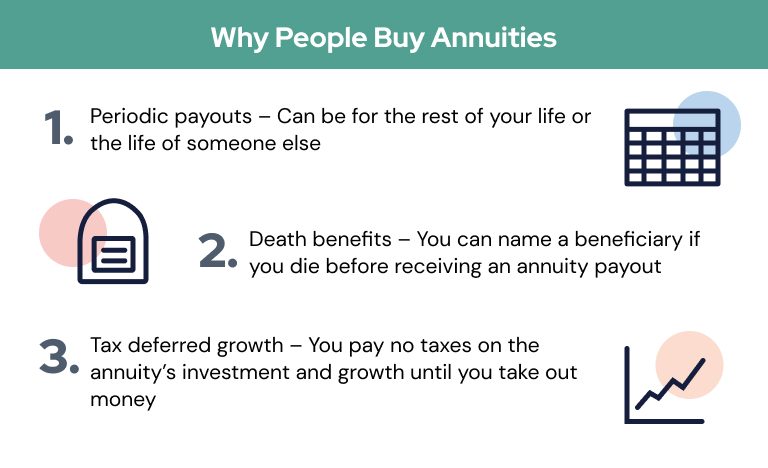

One of the primary reasons individuals opt for annuities is the promise of a guaranteed income stream for life. As life expectancies continue to rise, the fear of outliving one’s retirement savings is a genuine concern for many. Annuities offer a unique solution to this problem by providing a steady flow of income that you cannot outlive, regardless of how long you live.

By allocating a portion of your retirement savings to an annuity, you can effectively transform a lump sum into a reliable source of monthly payments. This income stream can be tailored to your specific needs, offering the flexibility to choose when you want to start receiving payments and how often you want to receive them.

Tax-Deferred Growth and Potential Tax Benefits

Annuities offer a unique tax advantage that can help your retirement savings grow more efficiently. Unlike many other investment vehicles, the funds within an annuity grow tax-deferred until you begin withdrawing the money. This means that you won’t have to pay taxes on the interest, dividends, or capital gains earned within the annuity until you start receiving payments.

Additionally, if you purchase an annuity with after-tax dollars (non-qualified annuity), only a portion of your payments will be taxed as ordinary income. The remaining portion will be considered a return of your original investment, which is not subject to taxation. This tax treatment can result in significant savings over the long run.

Principal Protection and Minimal Risk

For risk-averse individuals, annuities offer a level of security that is unmatched by many other investments. Fixed annuities, in particular, provide principal protection, ensuring that you won’t lose your initial investment due to market fluctuations. This feature can be particularly attractive for those nearing retirement or those who wish to preserve a portion of their savings from market volatility.

Furthermore, annuities are backed by the financial strength of the issuing insurance company, which is subject to stringent regulations and oversight. In the unlikely event that an insurance company becomes insolvent, state guaranty associations provide additional protection for annuity owners, further safeguarding your investment.

Legacy Planning and Wealth Transfer

Contrary to popular belief, annuities can be structured to provide more than just income for your own retirement. Many annuity contracts offer options to include beneficiaries, allowing you to leave a portion of your annuity’s value to your loved ones upon your passing.

This feature can be particularly appealing for those who wish to create a lasting legacy or ensure that their wealth is passed down to future generations. By structuring your annuity with a death benefit or survivorship clause, you can provide financial security for your spouse or other beneficiaries after you’re gone.

Customization and Tailored Solutions

One of the most attractive features of annuities is their inherent flexibility and customization options. Annuity providers offer a wide range of riders and additional features that can be added to your contract to better align with your specific needs and goals.

For example, you may opt for an inflation protection rider to ensure that your income payments keep pace with rising living costs. Or, you might choose a long-term care rider, which can provide additional funds to cover the costs of long-term care services if you ever need them. By tailoring your annuity to your unique circumstances, you can create a truly personalized retirement solution.

Diversification and Risk Management

In the world of investing, diversification is often touted as a key strategy for managing risk and achieving long-term growth. Annuities can play a crucial role in diversifying your retirement portfolio by offering a distinct asset class with unique risk and return characteristics.

By allocating a portion of your assets to an annuity, you can potentially reduce the overall volatility of your portfolio while still maintaining exposure to other investment vehicles, such as stocks and bonds. This diversification can help mitigate the impact of market downturns on your overall retirement savings, providing a layer of stability and peace of mind.

Simplicity and Peace of Mind

For many individuals, the prospect of managing their retirement savings and ensuring a steady stream of income can be daunting. Annuities offer a simple and straightforward solution by transferring the responsibility of managing your retirement income to the insurance company.

With an annuity, you can enjoy the peace of mind that comes with knowing that your future income is secure and guaranteed, without the need to constantly monitor and adjust your investments. This simplicity can be particularly appealing for those who prefer a more hands-off approach to their retirement planning or those who want to spend their golden years focusing on other pursuits.

In conclusion, the reasons for purchasing an annuity are multifaceted and deeply personal. Whether you seek guaranteed income, tax advantages, principal protection, legacy planning, or simply peace of mind, annuities offer a unique solution that can be tailored to your specific needs and goals. By understanding the benefits and features of annuities, you can make an informed decision about whether they should play a role in your retirement planning strategy.

Should You Buy an Annuity? Retirement Planning

FAQ

Is it a good idea to buy an annuity?

What is a common reason people purchase annuity?

How much does a $100 000 annuity pay per month?