If you’re considering enrolling in a Medicare Supplement Insurance (Medigap) Plan F, you might be wondering if all policies with the same letter offer the same benefits and coverage. It’s a valid question, and understanding the standardization of Medigap plans can help you make an informed decision. In this article, we’ll explore the similarities and differences between Medigap Plan F policies offered by different insurance companies.

Standardization of Medigap Plans

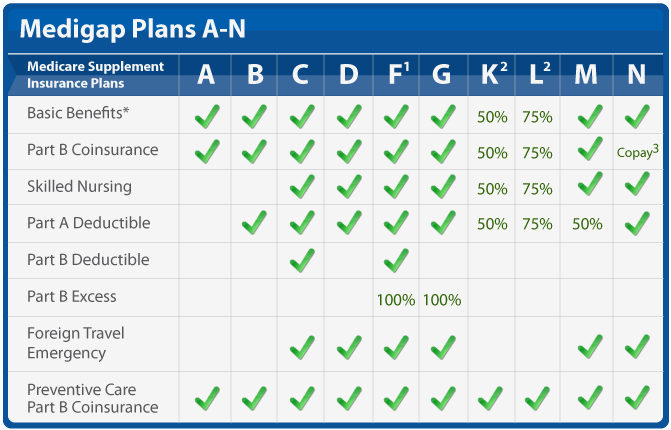

According to Medicare.gov, all Medigap policies are standardized by the federal government. This means that policies with the same letter, such as Plan F, offer the same basic benefits no matter where you live or which insurance company you purchase the policy from.

The standardization of Medigap plans ensures that you receive consistent coverage regardless of the insurance provider you choose. This consistency allows you to compare plans more easily and make an informed decision based on factors such as premiums, customer service, and the insurance company’s reputation.

What Does Medigap Plan F Cover?

Medigap Plan F is considered one of the most comprehensive supplemental insurance plans available. It covers the following benefits:

- Part A coinsurance and hospital costs (up to an additional 365 days after Medicare benefits are exhausted)

- Part B coinsurance or copayment

- Blood (first 3 pints)

- Part A hospice care coinsurance or copayment

- Skilled nursing facility care coinsurance

- Part A deductible

- Part B deductible

- Part B excess charges (up to the Medicare-approved amount)

- Foreign travel emergency (up to plan limits)

With Plan F, you essentially have minimal out-of-pocket costs for Medicare-covered services, making it an attractive option for those seeking comprehensive coverage.

Differences in Plan F Policies

While the basic benefits of Medigap Plan F are standardized, there can be some variations in the policies offered by different insurance companies. These differences may include:

-

Premiums: Insurance companies can set their own premiums for Plan F policies. The premiums can vary based on factors such as the insurer’s pricing methodology, your age, location, and whether you qualify for any discounts or household rates.

-

Underwriting Requirements: Some insurance companies may have stricter underwriting requirements than others, which can affect your eligibility for coverage or the premiums you pay.

-

Customer Service: The quality of customer service, claims processing, and overall reputation of the insurance company can vary, which may influence your decision when choosing a provider.

-

Additional Benefits: While the basic benefits are standardized, some insurance companies may offer additional benefits or riders to enhance their Plan F policies. These could include vision, dental, or hearing coverage, among others.

Comparing Plan F Policies

When comparing Medigap Plan F policies from different insurance companies, it’s essential to consider the following factors:

- Premiums and pricing structure (e.g., community-rated, issue-age-rated, or attained-age-rated)

- Financial strength and stability of the insurance company

- Customer service ratings and reputation

- Any additional benefits or riders offered

- Availability of household or spousal discounts

- Underwriting requirements and eligibility criteria

By carefully evaluating these factors, you can find the Medigap Plan F policy that best fits your needs, budget, and preferences.

Conclusion

While all Medigap Plan F policies offer the same basic benefits as defined by federal standards, there can be variations in premiums, underwriting requirements, customer service, and additional benefits offered by different insurance companies. It’s crucial to compare multiple Plan F options from reputable insurers to find the policy that provides the coverage you need at a price you can afford.

Remember, the standardization of Medigap plans ensures that you receive consistent core benefits, but considering additional factors can help you make the most informed decision when selecting a Medigap Plan F policy.

Medicare Supplement Plan F – Not worth it anymore?

FAQ

Are all Medigap F plans the same?

Why is Plan F being discontinued?

Are all Medigap policies the same?

Is Medicare Plan F worth keeping?