Paying bills can be a tedious task. Between keeping track of due dates, mailing in checks, and ensuring payments go through on time, it’s easy to get overwhelmed. Fortunately, Citizens Bank offers a convenient bill pay solution called One Time Bill Pay that takes the hassle out of paying your bills.

In this article, we’ll explore how Citizens Bank One Time Bill Pay works, its key benefits, and some frequently asked questions to help you determine if it’s the right online bill payment option for your needs.

Overview of Citizens Bank One Time Bill Pay

Citizens Bank One Time Bill Pay allows you to securely pay bills online without having to write and mail checks. With this service, you can pay almost any company or individual through your Citizens Bank checking account using your computer, smartphone or tablet.

To use One Time Bill Pay, you first need to log into your Citizens Bank online banking or mobile app. From there, you can add billers by searching for the company name or entering biller information manually. Citizens Bank has a network of over 18,000 billers available, so chances are high your major bills like utilities, credit cards, insurance, etc. will already be recognized.

You can set up one-time or recurring payments to appear on any date you choose once your payees are linked. When it’s time to pay, Citizens Bank will take the money out of the checking account you choose and send it to the biller electronically or by check if they don’t accept electronic payments.

One Time Bill Pay offers convenience along with control. You can plan your payments ahead of time so you never miss a due date, but you can also change or cancel payments if you need to. There are no checks to write, stamps to buy, or envelopes to mail.

Key Benefits of Citizens Bank One Time Bill Pay

Citizens Bank One Time Bill Pay offers several advantages that can save you time and simplify bill management:

Convenience

-

You can pay all of your bills at once online or on your phone, so you don’t have to write checks, buy stamps, or go to the post office.

-

Schedule one-time or recurring payments to over 18,000 billers.

-

Make same-day payments up until 9:00 PM ET weekdays.

Control

-

Choose exactly when and how much you pay each biller.

-

Edit or cancel payments anytime before the send date.

-

Set up text or email bill payment alerts and reminders.

Reliability

-

Payments are delivered electronically when available, helping ensure on-time delivery.

-

Bills paid by check are mailed with sufficient time to arrive before the due date.

-

Easy to track payment history and confirm bills are paid.

Security

-

256-bit SSL encryption protects your financial information.

-

Multi-factor authentication helps prevent unauthorized access.

-

No need to send sensitive account details through the mail.

-

FDIC insurance protects funds in your Citizens Bank accounts.

Savings

-

Avoid late fees by scheduling payments to arrive on or before due dates.

-

Skipping stamps and checks provides cost savings.

-

Set up automatic payments to qualify for bill discounts.

Mobile Access

-

Pay bills on-the-go using the Citizens Bank mobile app.

-

Receive bill payment notifications by text or push alert.

-

Enjoy an easy, intuitive mobile experience.

By taking advantage of these benefits, you can simplify bill management, avoid late fees, and take control of when and how your bills get paid each month or billing cycle.

Who is Citizens Bank One Time Bill Pay Best For?

Citizens Bank One Time Bill Pay is a versatile online bill payment solution that can benefit many types of customers, including:

-

Busy professionals who want an easy way to stay on top of bills.

-

Individuals and families seeking convenience and flexibility in bill payment.

-

Customers who travel frequently and need to pay bills remotely.

-

Those who want extra security around bill payment and notifications.

-

People who prefer electronic payments over mailing paper checks.

-

Disorganized bill payers who miss due dates or have trouble tracking payments.

-

Environmentally-conscious customers aiming to use less paper.

-

Anyone looking to consolidate bill payments in one place.

While One Time Bill Pay is beneficial for most bill management styles, it may provide the most value if you:

-

Have a lot of bills to keep track of each month

-

Frequently pay bills late or forget due dates

-

Want an automated system for bill management

-

Prefer electronic payments over checks

-

Travel often for work or leisure

-

Have a busy schedule with little time for billing tasks

-

Simply want a more convenient, secure way to pay bills

For those who only have a few bills or prefer paying bills manually, the benefits may be less significant. Evaluate your specific needs and preferences to decide if Citizens Bank One Time Bill Pay is right for you.

What Bills Can I Pay with Citizens Bank One Time Bill Pay?

The great thing about Citizens Bank One Time Bill Pay is that you can use it to pay almost any type of bill, including:

-

Credit cards – Mastercard, Visa, American Express, Discover, store cards

-

Utilities – electricity, gas, water, cable, internet, phone

-

Insurance – auto, health, life, home, rental

-

Loans – mortgage, auto, personal, student

-

Government – taxes, vehicle registration

-

Education – college tuition, student loans

-

Memberships – gym, Costco, AAA, alumni organizations

-

Subscriptions – Netflix, Spotify, newspapers, magazines

-

Medical – doctor visits, hospital bills, dental, prescriptions

-

Housing – rent, HOA fees

-

Charities and religious organizations

-

Individuals – friends, babysitters, personal services

As long as the biller accepts electronic payments or check payments delivered by mail, you should be able to use Citizens Bank One Time Bill Pay. Make sure to check with the payee first if you’re unsure. Citizens Bank also provides an online searchable database of over 18,000 supported billers.

How Much Does Citizens Bank One Time Bill Pay Cost?

The good news is there are no monthly fees to enroll in Citizens Bank One Time Bill Pay. It’s a free service provided to all online banking customers.

You can make unlimited electronic payments for free as well. The only charges you may incur are:

-

$0.50 per check payment to cover postage

-

Overnight check delivery fees if you need rush delivery

-

Insufficient funds fees if you overdraw your account

So if you primarily make electronic payments, it’s possible to use One Time Bill Pay at absolutely no cost. The convenience and reliability can provide great value without paying a cent.

Citizens Bank also offers premium Bill Pay services for additional fees if you need expanded features, but the basic One Time Bill Pay should suit most customers’ needs. Avoiding check fees and late fees often makes One Time Bill Pay cheaper than your previous bill payment method.

How Long Do Electronic vs. Check Payments Take?

One major benefit of Citizens Bank One Time Bill Pay is the ability to make electronic payments for fast delivery. Here is a comparison of how long electronic vs. check payments take to arrive:

Electronic Payments

-

Delivered in 1-3 business days after the send date

-

Often post to the account the next day

-

Fastest way to pay bills with One Time Bill Pay

Check Payments

-

Mailed 3-5 business days before due date

-

Arrive in 5-7 business days via standard mail

-

Allow extra time with holidays/weekends

-

Best for billers who don’t accept electronic payments

I recommend using electronic payments whenever possible for fastest delivery. But you can select check payment during setup if the biller doesn’t support electronic options.

No matter which method you choose, payments will arrive on time as long as you schedule them appropriately in advance of the due date. Citizens Bank factors in mailing time when sending physical checks.

Can I Use One Time Bill Pay Anonymously or Without a Citizens Bank Account?

Citizens Bank One Time Bill Pay is designed for use by Citizens Bank customers to pay bills from their checking accounts. You must have an eligible Citizens Bank checking account to use this service.

It is not possible to use One Time Bill Pay:

-

Anonymously without providing your info

-

As a non-Citizens Bank customer

-

By paying with credit/debit cards or external bank accounts

-

Without registering for Citizens Bank online/mobile banking

The service is exclusively for convenient bill payment by existing Citizens Bank account holders. For security reasons, full identification is required during signup.

If you don’t have a Citizens Bank checking account, consider opening one to take advantage of the free One Time Bill Pay convenience. It could be worthwhile if you pay a lot of bills each month.

Can I Pay Rent or Mortgage with Citizens Bank One Time Bill Pay?

Yes, Citizens Bank One Time Bill Pay can be used to pay your rent or mortgage. Here’s how to set it up:

There’s an easier way to pay and manage your loan – with Citizens Online Banking

Need to pay your loan? Now, you can make payments directly from Citizens Online Banking and access information and tools to help you take even greater control of your loan.

Already enrolled in Online Banking?

You can log in now to make payments, see loan information, enroll in Auto Pay, or sign up for eStatements.

Pay your credit card bill

FAQ

How do I Pay my citizen one bill?

How to Pay bills online with Citizens Bank?

How do I pay my Citizens Bank Bill?

Auto-pay is available. Call the office to set up automatic credit/debit card payments (a 3.5% customer assistance fee is applied) or automatic bank drafts (a free service). You may pay your bill at any Citizens Bank location. You must pay before the 10th of the month and present your bill stub with your payment.

Can I make payments from citizens online banking?

Now, you can make payments directly from Citizens Online Banking and access information and tools to help you take even greater control of your loan. Already enrolled in Online Banking? You can log in now to make payments, see loan information, enroll in Auto Pay, or sign up for eStatements. Not enrolled in Online Banking?

Does Citizens Bank charge a customer assistance fee?

All debit and credit card transactions will have a 3.5% Customer Assistance Fee applied. Auto-pay is available. Call the office to set up automatic credit/debit card payments (a 3.5% customer assistance fee is applied) or automatic bank drafts (a free service). You may pay your bill at any Citizens Bank location.

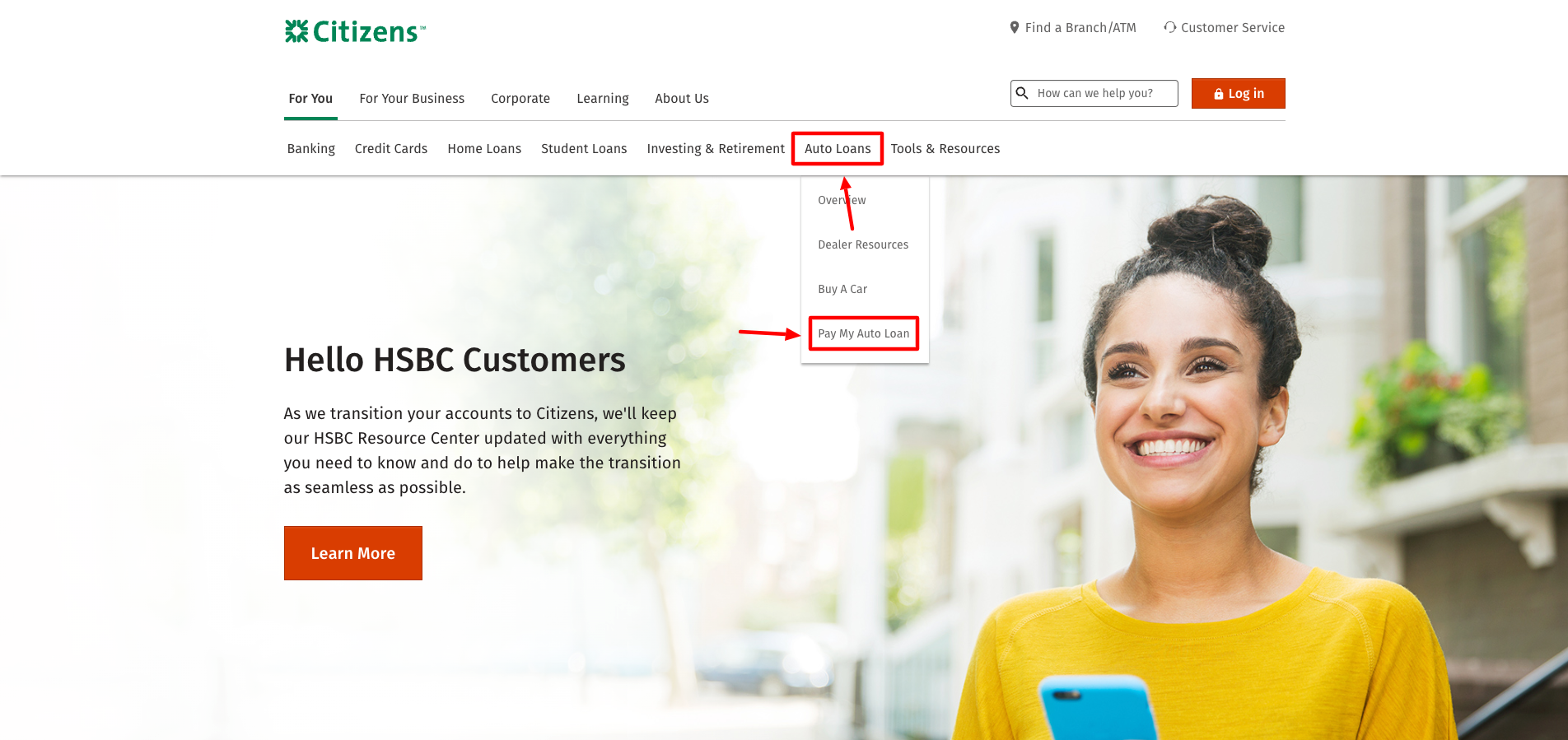

How do I pay a home equity loan at Citizens Bank?

Mail your payments to the address that appears on your statement. Dial 1-800-708-6680 for Pay by Phone Services. Same day processing. Simply stop by any Citizens branch during normal business hours. Easily make payments on your auto, boat, recreational vehicle, home equity line of credit, or home equity loan from Citizens.