Are you approaching Medicare eligibility and considering a Medigap policy? If so, it’s crucial to understand the enrollment process and timeline. Unlike the annual Medicare Open Enrollment Period, the Medigap Open Enrollment Period is a one-time opportunity that shouldn’t be missed. In this article, we’ll delve into the details surrounding this critical enrollment period, addressing the common question: “Do I have to enroll in Medigap every year?”

The Medigap Open Enrollment Period: A Six-Month Window

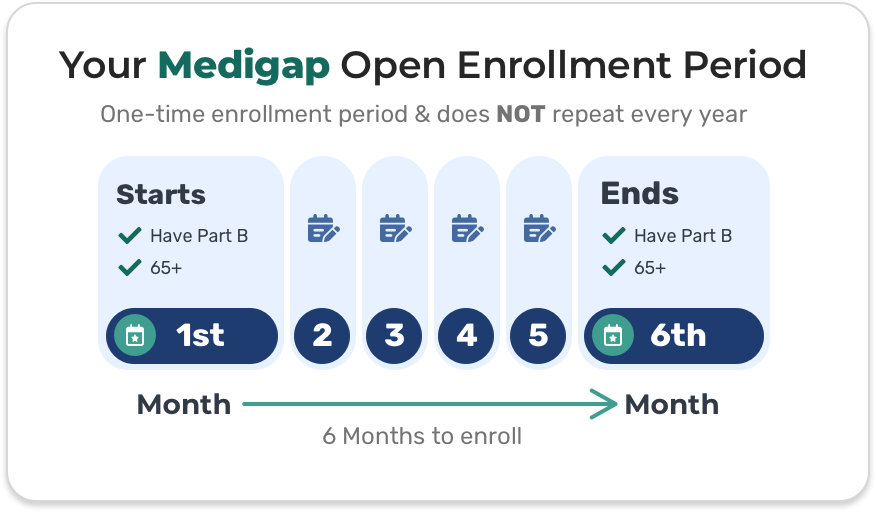

The Medigap Open Enrollment Period is a six-month window that begins on the first day of the month you turn 65 and enroll in Medicare Part B. During this period, you have the guaranteed right to purchase any Medigap policy offered by private insurance companies in your state, regardless of your health status.

Importantly, this six-month window is a one-time opportunity. It does not repeat annually like the Medicare Open Enrollment Period for other parts of Medicare. Once the Medigap Open Enrollment Period ends, insurance companies can deny coverage or charge higher premiums based on your medical history.

Enrolling While Still Employed

If you plan to continue working and maintain employer-sponsored health coverage after turning 65, you can still enroll in Medicare Part B during this time. Your Medigap Open Enrollment Period will begin once you sign up for Part B, even if you’re still covered by your employer’s plan.

Employer coverage often provides benefits similar to those offered by Medigap policies, so you may not need to purchase a Medigap plan immediately. However, it’s essential to be aware of your Medigap Open Enrollment Period and consider enrolling before it expires, as you might lose this guaranteed issue right.

Missed the Medigap Open Enrollment Period? Limited Options Remain

If you miss your Medigap Open Enrollment Period, your options for obtaining a Medigap policy become more limited. Insurance companies can now deny coverage or charge higher premiums based on your medical history and pre-existing conditions.

In certain situations, you may still have guaranteed issue rights, which require insurance companies to sell you a Medigap policy regardless of your health status. These situations include losing your employer-sponsored coverage, moving out of your Medicare Advantage plan’s service area, or having your Medicare Advantage plan leave the program.

However, it’s crucial to check with your state’s insurance department to understand your rights and options, as some states may offer additional protections beyond federal law.

Conclusion

The Medigap Open Enrollment Period is a crucial one-time opportunity to purchase a Medigap policy without facing medical underwriting or pre-existing condition limitations. Missing this window can make obtaining a Medigap policy more challenging and potentially more expensive.

If you’re nearing Medicare eligibility, it’s essential to understand the timing and significance of the Medigap Open Enrollment Period. By enrolling during this six-month window, you can secure comprehensive coverage and peace of mind for your future healthcare needs.

Can I Enroll in a Medigap Plan Year Round

FAQ

Do you need to enroll in Medigap every year?

Does Medigap automatically renew?

How long does Medigap last?

Does UnitedHealthcare automatically renew?