For individuals looking to submit their taxes in a timely manner, the hours of operation of their local Jackson Hewitt Tax Service can be a key factor in their decision-making process. Knowing when they are available and what type of services they offer is essential to ensure that you get the most out of the experience. This is why it’s important to understand the Jackson Hewitt hours of operation and the different services they can provide. From in-person assistance to online filing options, it’s important to understand what is available to meet your needs. In this blog post, we will discuss the different Jackson Hewitt hours of operation as well as the services they offer so that you can make an informed decision.

Jackson Hewitt Business Hours

Jackson Hewitt is a year-round tax preparation service. The company operates stores throughout the United States. You can get in touch with customer service via phone, email, regular mail, or social media if you have questions about products or complaints about in-store service. During regular business hours, you can also get in touch with the customer service team at your neighborhood shop.

Jackson Hewitt Regular Business Hours

- Weekdays: Most offices are open from 9:30 am to 6 pm local time, Monday through Friday. Contact your local office for specific hours of operation. The hours of operation vary by location.

- Weekends: Most businesses are closed on Saturday and Sunday. Several of the offices are open by appointment only. Contact your local office for specific hours of operation.

Jackson Hewitt Holiday Hours

The offices will adjust hours or close on the holidays. For specific holiday hours, get in touch with the customer service department or your local office. The observed holidays include:

- Christmas Eve

- Christmas Day

- New Year’s Eve

- Independence Day

- Labor Day

- Memorial Day

- New Year’s Day

- Thanksgiving Day

Jackson Hewitt Special Event Hours

Several of the local offices will host special events. For information and specifics regarding the special event, get in touch with customer service. You can also contact your local office for details.

Contacting Jackson Hewitt to Verify Business Hours

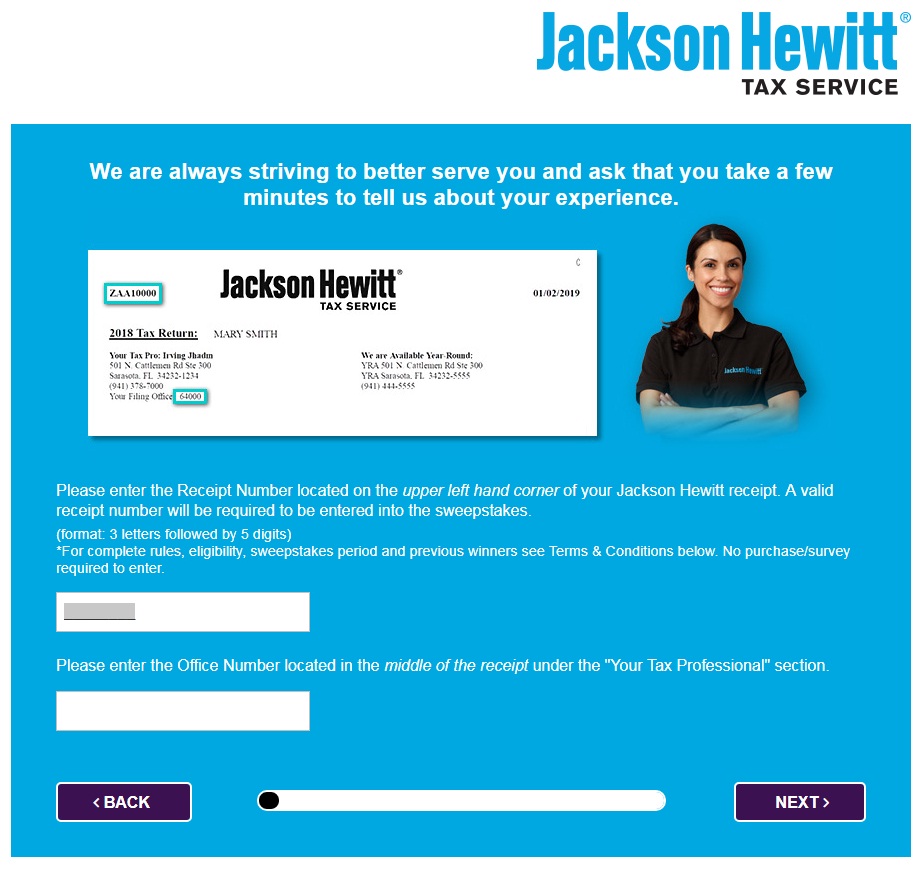

- Call 1-800-234-1040 to get in touch with the customer service division. You can reach the customer service department at your local office [] during regular business hours. The customer service department is available Monday through Friday from 8:30am to 5pm, EST.

- Email: Please use the customer feedback form to contact the customer service department if you need to do so via email. After sending your messages, you will receive an automated message. According to the message, a live agent will respond to your queries within 48 hours.

- Mail: Jackson Hewitt, 3 Sylvan Way, Suite 301, is the address for correspondence with the company. Parsippany, NJ 07054. Additionally, you can send messages to your regional representative [] for support with goods or services. Within five (5) business days, the customer service department tries to respond to your inquiries.

- Social Media: Customers can use social media to get in touch with the customer service team. Customers can post comments, questions, and general concerns on Facebook [], Twitter [], or YouTube []. Within 24 hours, the customer service department will respond to your inquiries. Concerns about individual accounts won’t be addressed by the customer service department on social media.

FAQ

How long does Jackson Hewitt refund take?

Who is cheaper Jackson Hewitt vs H&R Block?

Is Jackson Hewitt doing advances for 2022?

How much does Jackson Hewitt charge for tax relief?

| Free consultation? | Yes. |

|---|---|

| Average resolution fees* (high end) | Fees start at $500. Average fees run from $1,500 to $5,000. |

| Refundability of fees if IRS denies requests | Available but limited. |

| Contact options | Phone, email and mail. |